Financial Services We Provide

Personal Advice

Affordable Financial Plans and budgets for individuals and families

Your Taxes

How to legally reduce your tax bills Income Tax- Inheritance Tax- Capital Gain Tax

Pensions & Retirement

Set up a pension- review a current one- plan for retirement

Investment & Protection Advice

Find out where to invest your savlings or get Protection Insurance or Income protection

Pensions for Business Owners

There are special pensions for business people- extra benifits Have you the right pension?

Business Management Consultancy

Our 7 steps program has given some companies 100% profit improvement

Financial Advice For Individuals & Businesses

Financial advice is the process of helping people make informed decisions about their money. It can encompass everything from creating a budget to investing for retirement.

They typically have expertise in one or more financial areas, such as financial planning, insurance, mortgages or investment. They go through your financial life with you and give you advice and recommendations on making more efficient use of your money and making a financial plan to help you achieve the goals you have set for yourself.

Also, they should look at the financial risk to your family and review the insurance protection you have in place.

A financial advisor should be qualified and, if selling or advising on regulated financial products, be regulated by the Central Bank of Ireland. Don’t be afraid to ask about their qualifications and their Central Bank registration number.

Contact Us Today

"*" indicates required fields

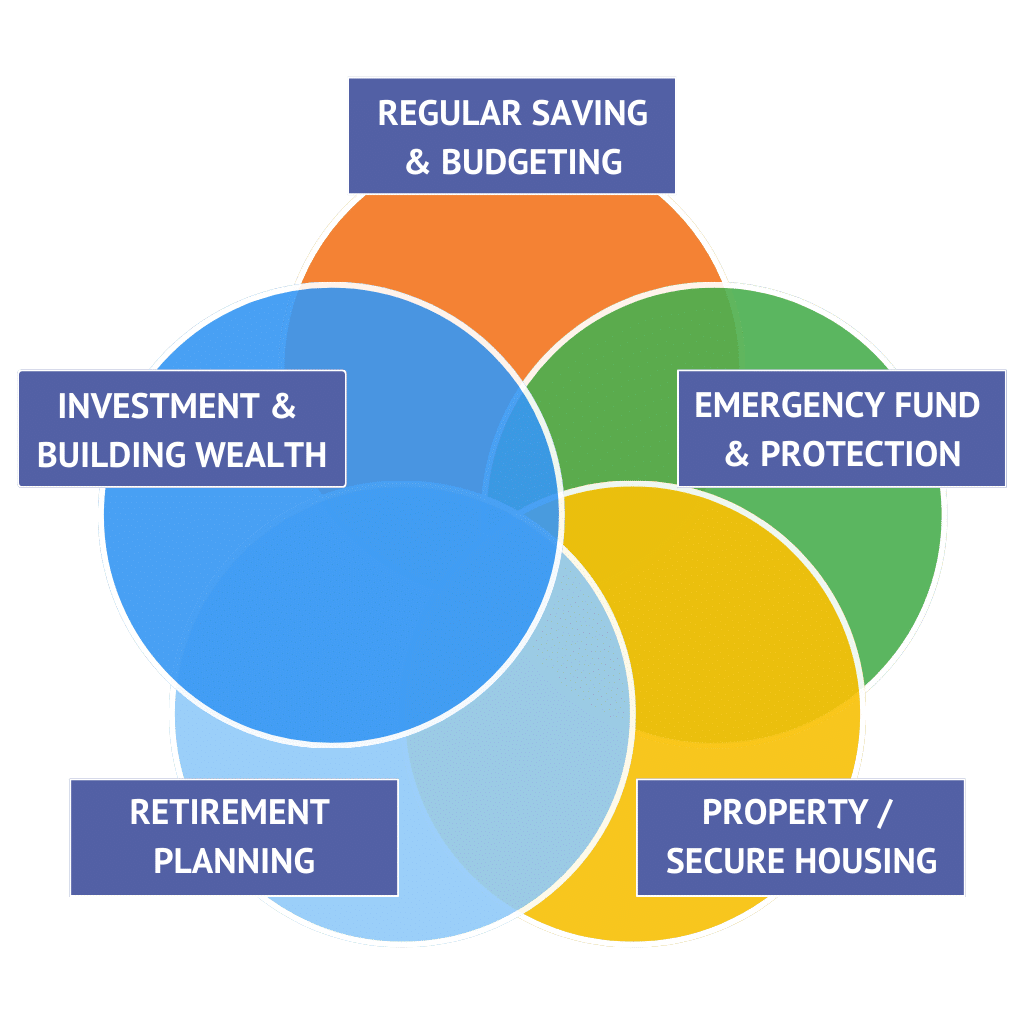

Benefits of Financial Planning

From budgeting and saving to investing and insurance planning, discover how you can create a financial plan that works for you.

Before you start putting together a financial plan, it’s important to know exactly where you stand financially. Evaluate your income, assets and liabilities, so that you have a clear picture of your current financial situation.

Client Testimonials

News & Stories

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

How We Can Help You

Our Life Insurance & Pension Partners

Book a Free 1:1 Initial Consultation

Let’s get on a call to discuss your personal and business finances with our experienced financial planners!

How Our Financial Planner Can Help You?

Our financial planner will do a review with you called the Fact Find to establish: What are your financial goals and dreams? What is your current financial position, and how do they match your plans? Do you own your own home? If not, do you plan to purchase one? Are you financially protected if anything goes wrong? What plans have you made for your retirement?

When you have provided all this information, we will then prepare a plan and recommendations based on your information. We will make recommendations to cover the highest risks first and the amount of money you can afford because it’s much better to be realistic about your current finances and make a plan.

So make a decision, get a sound advice – make a plan, and you will feel a lot better.

Steps to Get Started

STEP

Contact Us

Contact us by phone at 01 853 2727. You can also book a consultation here.

STEP

Information

Our advisors will take some information about your situation from you.

STEP

Advice

We offer you fair and balanced advice about how to achieve your goals.

Frequently Asked Questions

When should you get financial advice?

When you have a big decision to make or your life is changing, there’s a lot of information to look at before making that change.

- Should you save or invest your money?

- What are your mortgage options?

- Which insurance is right for you?

- Significant life changes, like weddings and starting a family

- Looking after and planning for your retirement

- Planning your long-term saving and budgeting

- How much will your goals cost?

How does asking for financial advice work?

When two options look incredibly similar, financial advice you can trust will allow you to make the best decision for yourself.

Emma needs life insurance. She’s gotten three quotes, and they all cost roughly the same. How does Emma choose? She’s tempted to go for the cheapest because it’s hard to know.

This is where financial advice helps.

Emma’s financial advisor knows all these products well and asks her a few extra questions. Her financial advisor can tell her the difference between those insurance policies and how they affect her.

The choice is still entirely up to Emma, and she decides to go for the second cheapest policy because it gives a funeral payment.

Her father died two years ago, and her mother had to take out a credit union loan for the funeral costs. Emma doesn’t want her family to go through that, and the price difference is minimal.

Being asked a couple of extra questions allowed Emma’s advisor to understand her situation better. Now Emma has a policy that fits her circumstances due to the financial advice.

How much does it cost?

Your initial call is free of charge. If our services can help you, we will inform you of the total charge in advance.

Most of our plans for the average household are €499.00.

What will I need to get my plan?

Generally, we look for bank account statements, annual & monthly costs, pensions statements and other information rela

Greenway Financial Advisors Limited is regulated by the Central Bank of Ireland. Registered No. C168372