You probably already know about pensions. But do you know the real meaning of a pension?

A pension is the money you live on once you retire, you will use to live on when you retire. The purpose of a pension is to replace the salary/revenue that you earned before retirement.

A pension can be considered a savings plan. It will allow you to save money in the long term in a tax-efficient way.

Pension investment funds are designed to give you tax relief on your earnings & grow your fund tax-free. Read more about how pension tax relief works here: tax relief on pension contributions.

Who pays into my pension plan?

It’s your responsibility to invest in your pension plan every year/month. Unless you are a member of a specific type of employer scheme, you will need to make contributions to your own pension.

Contributions are usually made annually, monthly, or through once-off lump sum payments.

If you are part of an occupational pension, you can ask your employer if they will make a contribution to your plan. However, you need to know that there is no legal requirement for them to do so.

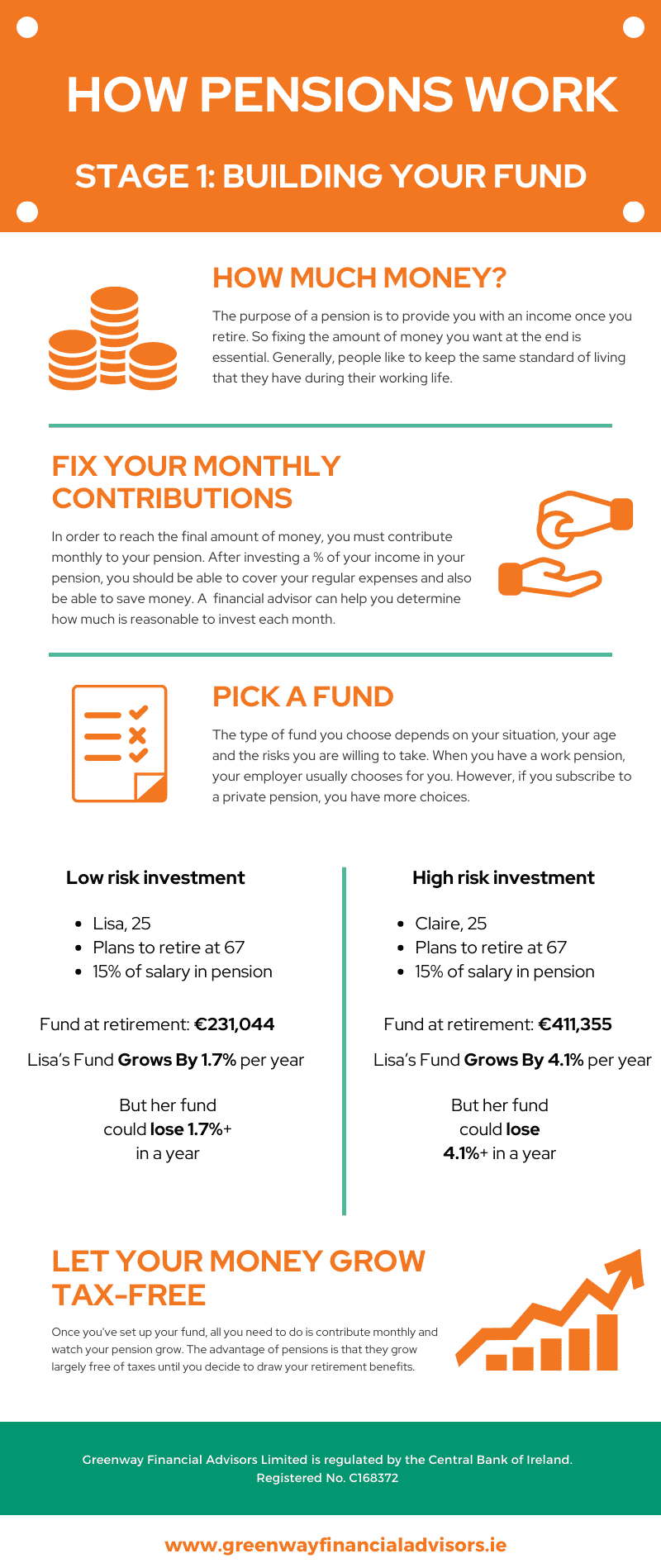

How much do I contribute?

There is no right or wrong answer. Ultimately it depends on your financial situation and what you can afford.

Also, it comes down to the level of income and the standard of living that you wish to have once you retire. It’s important to know that you can start a pension for as little as €50 per month.

The best thing to do is to contact a qualified financial advisor. They will help you set a budget and invest according to what you can afford.

A financial advisor will take into consideration your situation and your current standard of living. They will use this in order to find the ideal amount for your pension contributions.

How do I pick a pension fund?

If you wish to have a personal pension, you have a wide choice in terms of investment choice. It can be overwhelming, especially if you are not an expert on the subject.

However, in order to make an informed decision, you need to:

- Get as much relevant information as you can.

- Compare pension plans from different providers.

- Look at the charges you will pay.

- Look at the risks and benefits of each plan.

All of these steps are essential before your decision is made. Therefore, it is important to hire a professional.

Greenway Financial Advisors work with top Irish pension providers and will help you make the best decision.

What happens to my money when I invest it?

Financial advisors at Greenway can help you set up ‘Unit-Linked’ pensions. These pensions include:

- Personal Retirement Savings Accounts (PRSAs).

- Retirement Annuity Contracts (RACs).

- Personal Pensions.

- Personal Retirement Bonds (Buy-Out Bonds).

- Company Pensions.

- Executive / Directors Pensions.

With these kinds of pensions, you don’t own the investments directly, the way you would if you purchased shares.

Instead, you select a fund to invest in, and your pension contributions are used to purchase units in this fund.

Each of these individual units has a value, which is linked to the performance of the fund.

When the fund performs well, the value of the units goes up. When the fund performs badly, the value of the units goes down.

Example:

Aoife has a pension. Right now, she has 7,000 units in her chosen fund, and we’ll pretend she’s not contributing at the moment.

Here is how her fund value changes between two months:

| Month | June | July |

|---|---|---|

| No. units Aoife has | 7000 | 7000 |

| Value of 1 unit | €1.24 | €1.29 |

| Value Aoife’s units | €8,680 | €9,030 |

How are the funds designed?

Funds have a combination of different asset classes. Different asset classes have different levels of volatility and risk. The mix of asset classes in a fund gives the overall risk level of the fund. You need to choose a fund with a risk level you’re comfortable with.

Asset classes are the five main types of investment a fund can invest in:

- Cash: – money on deposit (e.g. cash in a bank).

- Bonds: – loans to companies or governments.

- Property: – bricks and mortar, property equities, or REITs (Real Estate Investment Trusts).

- Equities: – investment in company shares.

- Alternatives: – includes commodities, e.g. gold, copper, water infrastructure, and agriculture.

The fund manager will buy and sell these assets on behalf of the fund, with the aim that their value will increase over time.

Each asset class works in a different way and has its own rewards and risks, so it’s important to understand how they work before you make any investment decisions.

A Low-Risk fund might be made up of:

- 65% Bonds

- 26% Cash

- 9% Equity

A High-Risk fund might be made up of:

- 81% Equity

- 7% Alternatives

- 6% Property

- 4% Bonds

- 2% Cash

How do I check how MY pension is performing?

- You get information about your scheme, and a Statement of Reasonable Projection when you first join.

- Every active member of a pension scheme is entitled to receive an Annual Benefit Statement, that tells you how your pension is performing, and your projected benefits at your normal retirement age.

- Many pension providers will also enable you to log in to an online portal to check how your pension is performing.

- If you work with a financial advisor, they can help you to check your pension performance, and answer all your questions.

- At Greenway, we check our clients’ pension funds every 3 months or 4 times per year.

What happens when you retire?

Once you retire, you will be able to enjoy the benefits accrued from your pensions plan.

You will be allowed to take a portion of the money as an immediate tax-free cash sum. The balance will be used to provide you with a pension or a residual pension pot.

Get in touch

You can get in touch directly with a financial advisor by calling 01 853 2727.

If you want to be called back and want to tell us more about your situation, you can contact us here.

A financial advisor will help you set up a pension plan if needed or review your current pension. We also help individuals who are close to retirement manage their pensions and prepare for retirement.

Greenway Financial Advisors Limited is regulated by the Central Bank of Ireland. Registered No. C168372