Smart Financial Planning

Lay the groundwork for financial independence with a solid plan.

Discover what you need to know about financial planning today!

Contact Us Today

Call 01 853 2727 for your free initial consultation

Benefits of Financial Planning

From budgeting and saving to investing and insurance planning, discover how you can create a financial plan that works for you.

Before you start putting together a financial plan, it’s important to know exactly where you stand financially. Evaluate your income, assets and liabilities, so that you have a clear picture of your current financial situation.

Personal Financial Services

Pensions & Retirement

Set up a pension, review your current one or ask for advice.

Life Insurance

A life insurance policy can provide your family with financial security.

Mortgage Protection

There are limits on what you can invest in your pension. Find out about your maximum pension.

Income Protection

A vital consideration if you have dependents who rely on your income

Our Approach to Your Financial Independence

All of our recommendations are realistic and will allow you to be financially independent even in an emergency.

Saving money every month can be a challenge. Whether it is for your retirement, your mortgage or your children, having some money aside is essential. This is why our financial advisors are there to help you take control of your finances.

Through our personal financial advice, we work with you to build a plan that preserves your wealth, your resources, your income, and the lifestyle of your family.

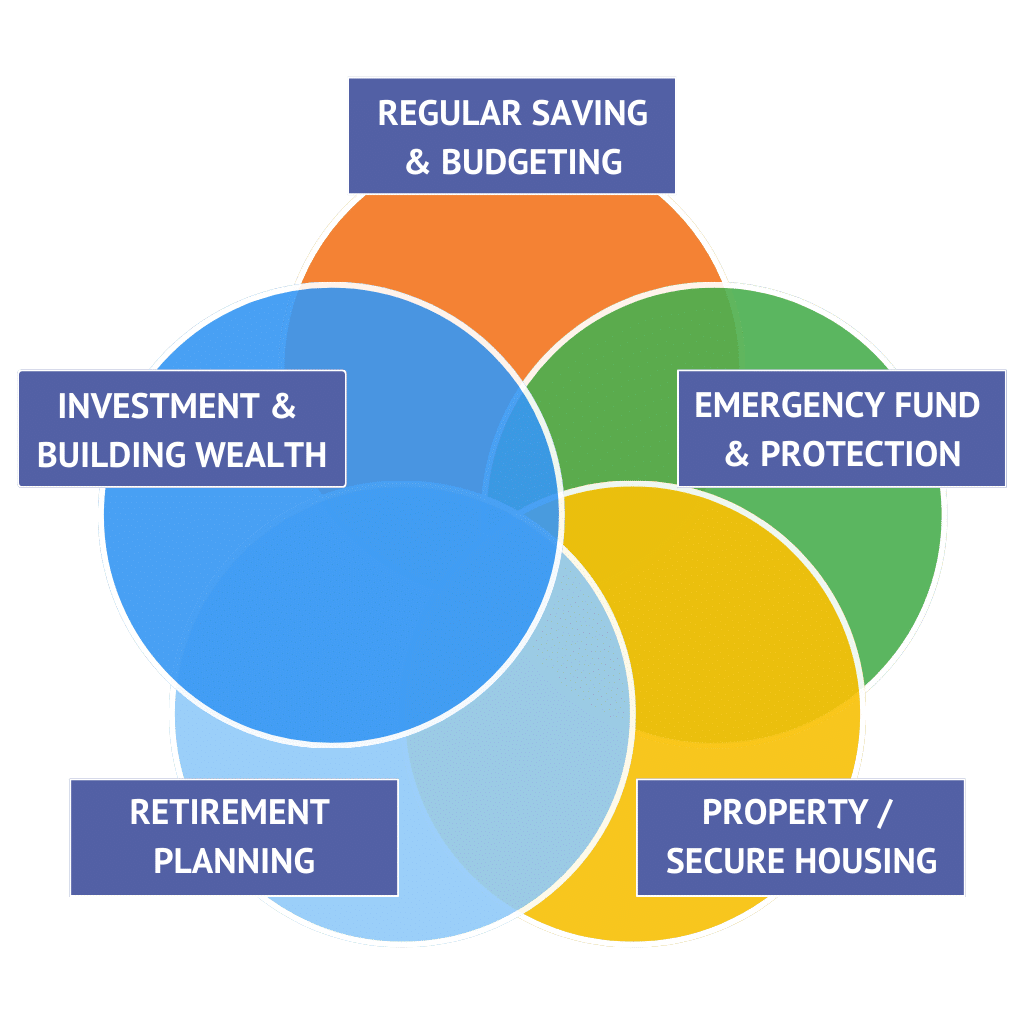

Step 1: Regular Saving & Budgeting

Before you start putting together a financial plan, it’s important to know exactly where you stand financially. Evaluate your income, expenses and debts, so that you have a clear picture of your current financial situation.

Step 2: Emergency Fund & Protection

Step 3: Property / Secure Housing

Step 4: Planning for Retirement

Step 5: Investment & Building Wealth

Book a Free 1:1 Initial Consultation

Let’s get on a call to discuss your personal and business finances with our experienced financial planners!

Our Financial Planning Process (Money Advice)

Step 1: What are your goals?

Step 2: What is your income?

Step 3: What are your Expenses?

Step 4: Analysis & suggestions

We’ll make suggestions about where you can save some money, make some money and how to protect your life and your retirement.

Step 5: Your report and budget

Step 6: Come back and ask us questions

Our Qualified Financial Advisors

Debbie Cheevers

Qualified Financial Advisor

Debbie qualified as APA in 2017 and a fully qualified financial advisor (QFA) in 2018. She is a tax technician member of the Irish Tax Institute.

She believes product knowledge is key to helping customers make the right choices.

Debbie was born in Dublin and graduated from NCAD with a degree in Visual Communication. She brings a strong customer service background to Greenway.

Adrian Gallagher

Adrian has 45 years of business experience gained from working in a range of business areas from oil recycling, oil distribution, print and digital media and latterly in insurance and mortgage products. He qualified as QFA in 2016.

Married with three adult children and four grandchildren, Adrian uses his life experiences to help advise clients on the type and level of insurance cover and pensions they should have.

Adrian has been interested in sailing and boats all his life. In 2013 he took a year off, calling it his Gap Year and motored a cruiser from Ireland to Berlin via Paris. You can see more on this on www.adrianandnualasgapyear.com

Providers We Work With

Steps to Get Started

STEP

Contact Us

Contact us by phone at 01 853 2727. You can also book a consultation here.

STEP

Information

Our advisors will take some information about your situation from you.

STEP

Advice

We offer you fair and balanced advice about how to achieve your goals.

Personal Financial Advice in Ireland

Our best financial advisors give you a financial plan to follow and guide you along the way. Thanks to Greenway’s money advice in Ireland, you will clearly understand your financial situation. This will give you all the tools to live a secure and stable life.

If you want a full life plan financial plan or simply advice on a particular issue, our financial advisors are here to help. These issues can include budgeting, investments, savings, examining current pension provision, inheritance issues and planning for retirement. Contact us for thoughtful financial advice in Ireland.

Frequently Asked Questions

When Should You Get Financial Advice?

Should you save, or invest your money?

What are your mortgage options?

Which insurance is right for you?

Big life changes, like weddings and starting a family

Looking after and planning for your retirement

Planning your long-term saving and budgeting

Who Needs Financial Advice?

How Does Financial Advice Work?

Emma needs life insurance. She’s gotten three quotes, and they all cost roughly the same. How does she choose? She’s tempted to go for the cheapest, because it’s hard to know what the difference is.

This is where financial advice helps.

Emma’s financial advisor knows all these products well, and asks her a few extra questions. Her financial advisor is able to tell her the difference between those insurance policies, and how they affect her.

The choice is still completely up to Emma, and she decides to go for the second cheapest policy, because it gives a funeral payment. Her father died two years ago, and her mother had to take out a credit union loan for the funeral costs. Emma doesn’t want her family to go through that, and the difference in price was minimal.

Being asked a couple of extra questions allowed Emma’s advisor to understand her situation better. Now Emma has a policy that fits her circumstances, due to the financial advice she received.

How much does financial advice cost?

Most of our personal financial plans for the average household are €499.00 including VAT

What will i need to get my financial plan?

How We Can Help You

Greenway Financial Advisors Limited is regulated by the Central Bank of Ireland. Registered No. C168372