Blogs

Inheritance Tax Ireland | How To Avoid Legally

This content has been updated to reflect changes in Budget 2025Are you looking for ways to avoid inheritance tax? Inheritance tax is something people forget about until it's too late. In 2018 revenue collected over €466.3 million from inheritance tax payments, but it...

How To Calculate Tax On Pension Income?

Planning for retirement involves more than just saving money; understanding how your pension income is taxed is essential for managing your finances effectively. Taxes on pension income can be complex, but knowing the basics can help you avoid surprises and make...

How Much Do I Need to Retire in Ireland? Complete Guide

Discover how much you need to retire comfortably in Ireland. Learn about retirement costs, state pension, personal savings, and more. Start planning today!

A Simple Financial Planning Framework for Ireland

As we head into a new year, many people in Ireland are setting goals—financial goals often topping the list. Whether you’re trying to save for a home, reduce debt, invest wisely, or plan for retirement, having a financial planning framework tailored for Ireland is...

Organise Your Finances for the New Year 2026

How to organise your finances for the New Year, follow a financial checklist in Ireland, and start the year with clarity and confidence. The New Year is one of the most effective times to reset your personal finances. After Christmas spending, a full calendar year...

UK Pension to Ireland Your Guide to QROPS Transfers

For many people who have worked in the UK and are now living or planning to retire in Ireland, one key financial question looms: “Can I transfer my UK work or private pension to Ireland?” Please note this does not apply to the UK state pension. The answer is mostly...

How Illness Benefit in Ireland Works: A Complete Guide

If you are unable to work due to illness and meet certain conditions, you may be entitled to Illness Benefit in Ireland. This is a short-term payment provided by the Department of Social Protection (DSP) to help support your income while you recover. In this guide,...

State Savings Options In Ireland

When it comes to safe, government-backed savings solutions, State Savings Ireland is hard to beat. Offered by the National Treasury Management Agency (NTMA) and administered through An Post, these products are 100% guaranteed by the Irish State, free from fees, and,...

Are Pensioners Exempt From Property Tax in Ireland?

The annual Property Tax in Ireland is called the Local Property Tax (LPT). Local Property Tax is charged on residential properties in Ireland. There are no specific local property tax exemptions for pensioners. However, there are a number of deferred options available...

Capital Gains Tax Ireland 2025 – Rates, Reliefs, and How to Pay CGT

If you're investing, selling property, or transferring assets, understanding Capital Gains Tax (CGT) in Ireland is crucial. As of 2025, capital gain tax in Ireland remains one of the highest in the EU, making tax planning more important than ever. Whether you’re...

Best Savings Account Ireland 2025 – Where to Get the Highest Rates

If you’re wondering about the best savings account in Ireland are you’re not alone. With interest rates are changing and more savings products available, choosing the right savings account in Ireland has never been more important. Whether you’re planning for a...

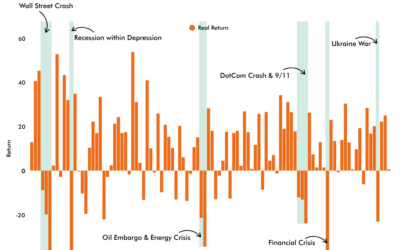

Investing Amid Volatility: A Long-Term Guide for Irish Investors

In recent months in particular, financial markets have seen considerable volatility. Global economic uncertainty, interest rate adjustments, and geopolitical tensions have all contributed to dramatic market swings. For many investors and pension savers, these...

Why Financial Advice Matters More Than Ever in 2025

In today’s unpredictable economic climate, more Irish consumers are turning to Financial Brokers for expert guidance — and it’s paying off. The newly published Value of Advice Report 2025 by Brokers Ireland shows just how much professional financial advice can...

What Are the Best Financial Tips for Your 20s?

Your 20s are an exciting time filled with new experiences! But they’re also the perfect stage to set a solid financial foundation. Making smart financial choices early on can lead to greater security, freedom, and opportunities in the future. It might seem challenging...

New Pension Rules 2025 for Company Directors

The Irish government’s Finance Bill, published on 11 October 2024, introduces key updates to pension rules that are set to take effect in 2025. These changes impact Personal Retirement Savings Accounts (PRSAs), employer contributions, and also bring in auto-enrolment...

What’s the Difference Between Income Protection and Critical Illness Cover?

Life can take unexpected turns, and when illness or injury comes, it’s essential to have the right financial protection in place. To help you prepare for these challenges, two common types of coverage can provide peace of mind: Income Protection and Critical Illness...

How Much Does Executive Income Protection Cover in Ireland?

Running a business comes with many challenges, and ensuring financial stability during unexpected times is essential. Executive income protection provides a reliable solution for company directors and key employees if illness or injury prevents them from working....

How Much Does Partnership Protection Insurance Cost in Ireland?

When it comes to running a business partnership, planning for the unexpected is crucial. If one partner were to pass away, financial challenges could quickly follow, impacting both the business and the deceased partner’s family. Partnership protection insurance...

7 Tips for How You Could Grow Your Money in Your 30s and 40s

Entering your 30s and 40s is an exciting time, often filled with career advancements, growing families, and new responsibilities. Meanwhile, it’s also the perfect moment to focus on growing your money and building a stable financial future. Many of us may wonder how...

UK Pension Transfers to Ireland Using QROPS: A Comprehensive Guide

For individuals moving from the UK to Ireland or planning retirement in Ireland, transferring a UK pension using a Qualifying Recognised Overseas Pension Scheme (QROPS) can be a beneficial financial strategy. This guide outlines the key details, benefits, and...

Volatility A Feature of Investment Markets

The past few months have been particularly turbulent for investors. Market volatility has surged, leading to sharp declines in stock prices and causing understandable anxiety among investors and pension holders. While these fluctuations may feel alarming, it's...

Market Volatility & Managing Your Investments

Market volatility is an inevitable part of investing, but that doesn’t make it any less stressful for clients. As financial advisors, it’s our role to provide perspective, keep clients focused on long-term goals, and help them avoid emotional decision-making. We've...

February 2025: A Mixed Start to 2025

As we step out of February 2025, navigating personal finances remains a key priority for individuals and families across Ireland. Ireland's economy has shown resilience amid global uncertainties. GDP growth is expected to remain steady, though inflation pressures...

January 2025: A Financially Impactful Start To The Year

January 2025 has kicked off with major events, including the formation of a new government and Storm Éowyn, which caused significant disruptions. Additionally, there are several financial changes will impact your personal finances.If you haven’t already, now is the...

Best Ways to Reduce Income Tax in Ireland For Self Employed

Are you feeling stressed by the amount of income tax you pay each year and looking for effective ways to reduce it? Paying income tax is a necessity, but understanding how to minimise your tax liability can significantly impact your financial well-being. Many...

The Ultimate Guide to Auto Enrolment for Pensions

Welcome to The Ultimate Guide to Auto Enrolment for Pensions: Everything You Need to Know. Are you unsure about the complexities of pension schemes and how auto enrolment works? Look no further! In this comprehensive guide, we'll walk you through the ins and outs of...

APRC VS Interest Rate: What’s the Difference?

APRC & Interest Rates On Mortgages Understanding APRC vs Interest rate is essential for knowing what you are being charged on your mortgage. Your mortgage is likely the most significant financial commitment you will ever make, so it's essential to understand the...

Pensions in Ireland: Why They’re a Smart Choice

Pensions in Ireland are one of the most effective ways to secure your financial future. A pension isn’t just about planning for the future—it’s also about making smart financial decisions today. With tax savings, investment growth, and financial security, pensions are...

Self-employed pensions

Self-employed pensions are designed for individuals who work for themselves. As a self-employed individual, it is essential for you to think about retirement and plan for the future. Because you’re not an employee, you can’t benefit from an occupational pension. When...

What Taxes Do You Pay On Investments

Are you confused about the taxes you pay on investments? What taxes do you pay on investments. Many investors find it challenging to understand the complexities of investment taxes. In this blog, we'll explain different types of investment taxes, including capital...