Secure Your Financial Future

Financial Advice in Ireland — Expert Irish Financial Advisors

Looking for trusted, personalised financial advice in Ireland?

Greenway Financial Advisors offers expert guidance to help individuals, families, and business owners across Ireland grow, manage, and protect their wealth.

Our qualified financial advisors (QFAs) provide tailored financial planning services rooted in Irish regulations and financial best practices.

Regulated by the Central Bank of Ireland

5-Star Rated by Clients on Google

Clear, practical guidance (no jargon)

Why Financial Advice Matters in Ireland

Whether you’re planning for retirement, buying a home, saving for your children’s education, or managing investments, professional financial advice helps you make informed, confident decisions.

Our advisors understand the specific financial challenges and opportunities faced by people in Ireland.

Client Testimonials

Personal Financial Services

Planning & Personal Budgets

Create strategies to manage your finances & meet your financial goals.

Protection & Disaster Planning

Retirement & Pension Planning

We help you navigate Irish pension schemes, including PRSAs and occupational pensions, ensuring you maximise tax relief and retirement income.

Investment & Wealth Building

Whether you’re starting to invest or growing an existing portfolio, we offer personalised investment strategies based on your goals, risk tolerance, and Ireland’s financial landscape.

What Makes Greenway Financial Advisors Different

- Regulated by the Central Bank of Ireland

- Advisors with QFA qualifications and years of experience

- Transparent, fee-based advice tailored to your life goals

- Based in Dublin and serving clients nationwide

Our financial plans are custom-made for each individual or couple. We make sure that all your needs are taken into account. The objective is to improve your financial situation.

All of our recommendations are realistic and will allow you to be financially independent even in an emergency.

Saving money every month can be a challenge. Whether it is for your retirement, your mortgage or your children, having some money aside is essential. This is why our financial advisors are there to help you take control of your finances.

Through our personal financial advice, we work with you to build a plan that preserves your wealth, your resources, your income, and the lifestyle of your family.

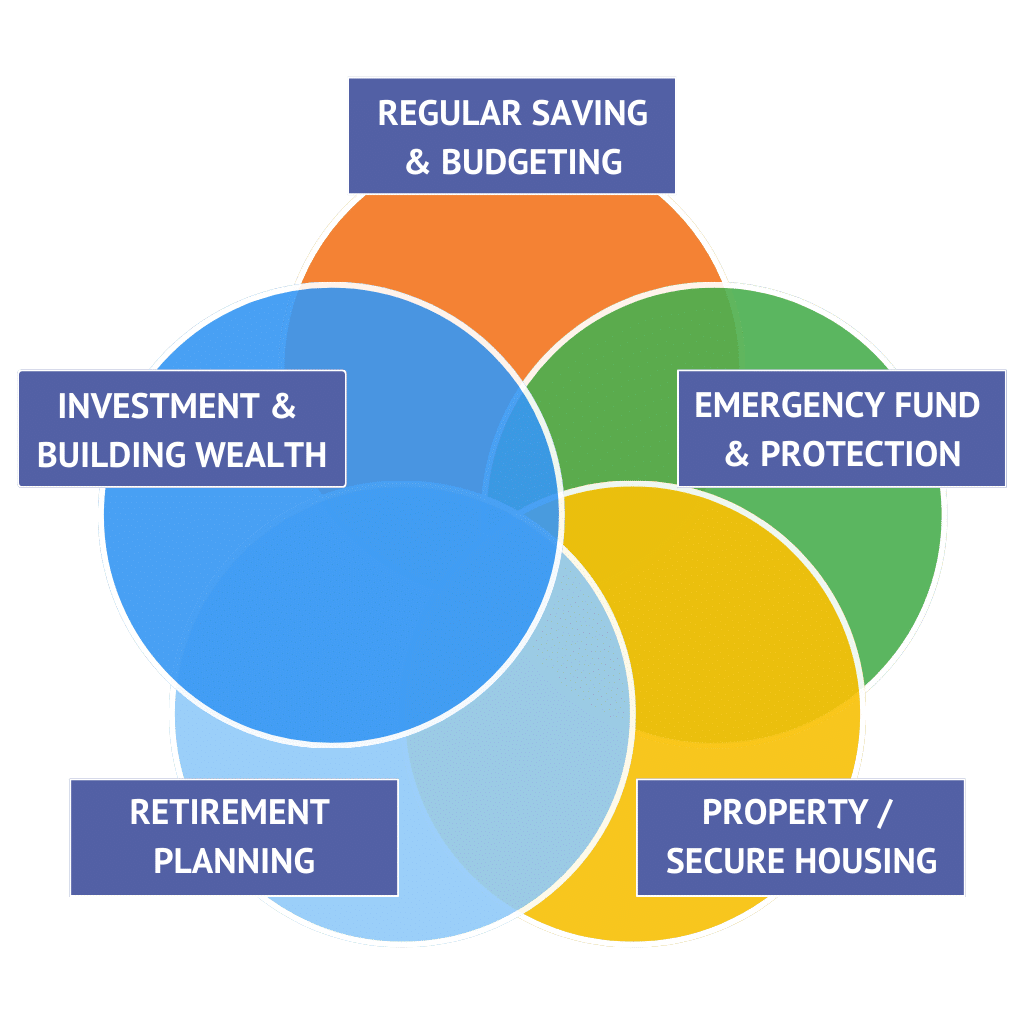

Step 1: Regular Saving & Budgeting

Before you start putting together a financial plan, it’s important to know exactly where you stand financially.

Evaluate your income, expenses and debts, so that you have a clear picture of your current financial situation.

Step 2: Emergency Fund & Protection

One of the most important steps in setting up an emergency fund is to open a separate savings account specifically for this purpose.

An emergency fund account should be kept separate from your other accounts, as it serves its own specific purpose.

This helps you stay focused on saving for emergencies, rather than spending this money on something else.

Step 3: Property / Secure Housing

One of the first steps to buying a house is to determine your budget.

After you’ve identified how much you’re able to spend, start looking for homes in locations that meet your criteria – making sure they are also within your price range.

Step 4: Planning for Retirement

Planning for retirement in Ireland is an important process that requires careful consideration and preparation.

It is important to use a financial advisor to understand and plan your retirement. If you leave it until you reach retirement you can make the situation harder.

Step 5: Investment & Building Wealth

Investing can be a great way to build wealth and grow your money over time.

There are many options for investment including bonds, mutual funds, exchange-traded funds, property and buying company shares directly.

Before investing, it’s important to research and understand the risks associated with each type of investment and to consult with a financial advisor or investment professional to determine what investment strategy is best for your individual needs and goals.

FAQs Common Questions About Financial Advice in Ireland

Do I need a financial advisor in Ireland?

If you have long-term financial goals or are facing major financial decisions, a financial advisor helps you make the most of Ireland’s tax laws and financial products.

How much does financial advice cost?

Are your advisors qualified?

Yes, all our advisors are QFAs (Qualified Financial Advisors) and regularly update their training in line with Irish regulations.

Can I get advice remotely?

Absolutely. We work with clients across Ireland via Zoom and phone.

Book a Free Financial Consultation

Take the first step toward financial clarity.

Book a no-obligation call with one of our expert financial advisors in Ireland today.

Our Financial Planning Process (Money Advice)

1. Discovery Call

We learn about your goals, concerns, and financial habits.

2. Personal Finance Review

We assess your income, expenses, and current savings.

3. Pensions, Investments & Protections

We review all existing, Pensions, Investments & Protections and suggest ways to improve them.

4. Specific Areas We Can Cover

We explore the financial issues that matter most to you.

5. Strategy & Recommendations

You’ll receive clear, actionable advice that can start to be implemented.

6. Ongoing Support

Ask questions anytime. We’re here to guide you forward.

Our Qualified Financial Advisors

Ian Gallagher

Director & Qualified Financial Advisor (QFA)

Ian was born in Portlaoise and studied creative digital media. He has worked for a number of businesses that heavily focused on customer experience.

Ian qualified as APA in 2023 and a fully qualified financial advisor (QFA) in 2024.

His primary role in Greenway is to manage all our online technology and customer relationships systems.

Having worked in a number of industries, Ian has specialised in customer experience and building customer relationships.

Debbie Cheevers

Qualified Financial Advisor (QFA), Retirement Planning Advisor (RPA), Technician Member of the Irish Taxation Institute

Debbie was born in Dublin and graduated from NCAD with a degree in Visual Communication.

She brings a strong customer service background to Greenway. Debbie qualified as APA in 2017 and a fully qualified financial advisor (QFA) in 2018.

She believes that product knowledge is key to helping customers make the right choices. In 2022 Debbie gained a tax qualification as a Technician Member of the Irish Taxation Institute.

In early 2025 she received her Retirement Planning Advisor (RPA) accreditation.

Adrian Gallagher

Managing Director & Qualified Financial Advisor (QFA)

Adrian has 45 years of business experience gained from working in a range of business areas from oil recycling, oil distribution, print and digital media and latterly in insurance and mortgage products. He qualified as QFA in 2016.

Married with three adult children and four grandchildren, Adrian uses his life experiences to help advise clients on the type and level of insurance cover and pensions they should have.

Adrian has been interested in sailing and boats all his life. In 2013 he took a year off, calling it his Gap Year and motored a cruiser from Ireland to Berlin via Paris. You can see more on this on www.adrianandnualasgapyear.com

Our Pension & Protection Partners

Personal Financial Advice in Ireland

Whether you are planning to buy a house, pay your bills, or even plan for your retirement, managing your money is important.

The sooner you start planning your finances, the better it is. Getting money advice from a professional is a great way of laying out your goals and finding a way to reach them.

Our best financial advisors give you a financial plan to follow and guide you along the way. Thanks to Greenway’s money advice in Ireland, you will clearly understand your financial situation. This will give you all the tools to live a secure and stable life.

If you want a full life plan financial plan or simply advice on a particular issue, our financial advisors are here to help.

These issues can include budgeting, investments, savings, examining current pension provision, inheritance issues and planning for retirement. Contact us for thoughtful financial advice in Ireland.

How We Can Help You

Greenway Financial Advisors Limited is regulated by the Central Bank of Ireland. Registered No. C168372