If you’re looking for a simple and easy way to budget your money, the 50/30/20 money management method may be perfect for you. This technique prioritizes needs over wants and could help you achieve financial freedom in no time. Learn how this strategy works and manage your money smarter.

What is the 50-30-20 budget system?

The 50-30-20 budget is a personal budgeting plan made popular by Elizabeth Warren in her 2005 book, “All Your Worth: The Ultimate Lifetime Money Plan”.

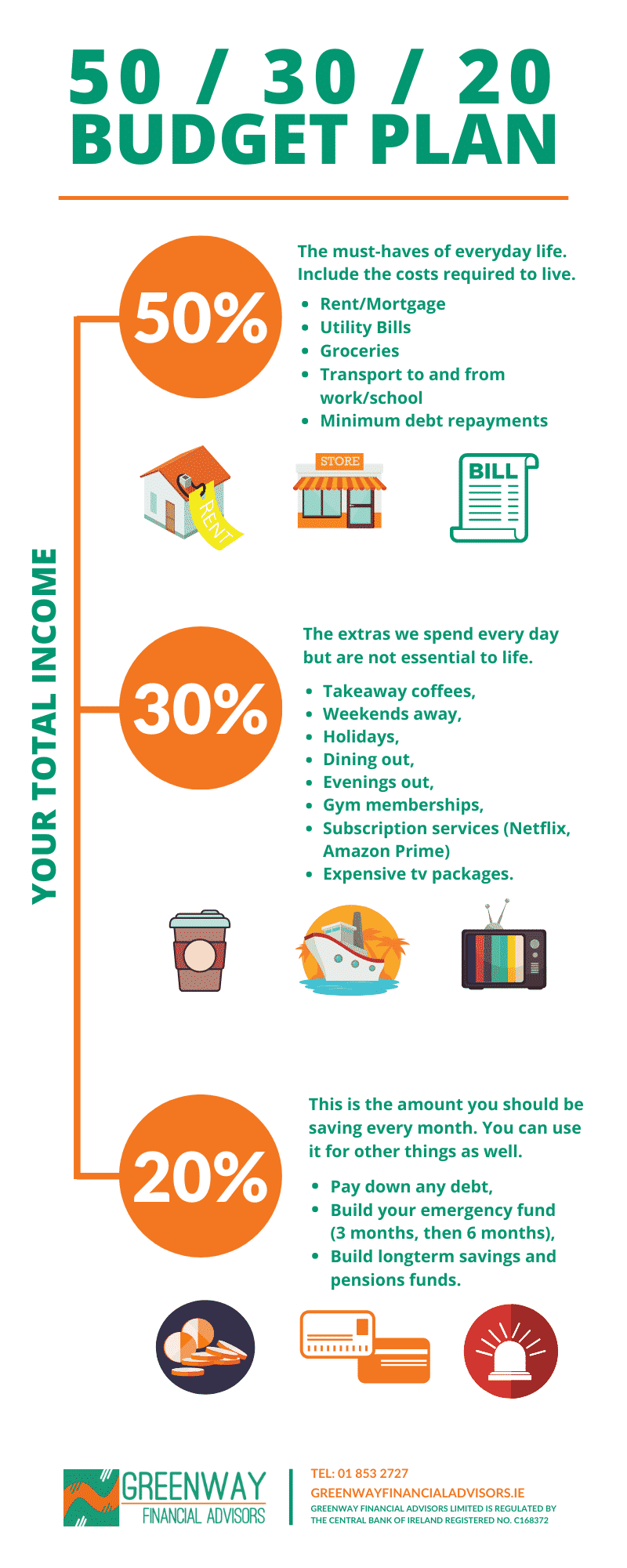

It’s a very simple way of breaking down your income into 3 categories. Needs 50%, Wants 30% and Savings 20%.

50-30-20 Budget Calculator

50 30 20 calculators are used to calculate your savings and how your savings and spendings coincide with your net income.

Using your net income (income after tax) gives you a clear breakdown of where your spending should be each month.

Understand the 50/30/20 Method.

The 50/30/20 rule is a financial strategy that allocates 50% of your income to needs, 30% to wants and 20% to savings. It’s important to understand each part of the strategy to make sure it’s working for you.

Necessities are items that are necessary for survival such as rent payments, utilities and groceries.

Wants involve things that make life more enjoyable like vacations and entertainment.

Finally, savings help give you financial security for your future by putting money into retirement accounts and emergency funds.

- Are you spending more or less in any of the 3 areas?

- Where do you think you could do better?

- Do you think you are totally lost with your personal budget?

Needs of 50 30 20 budget: The must-haves of everyday life. Include the costs required to live.

- Rent/Mortgage

- Utility Bills

- Groceries

- Transport to and from work/school

- Minimum debt repayments

Wants of 50 30 20 budget: The extras we spend every day but are not essential to life.

- Takeaway coffees,

- Weekends away,

- Holidays,

- Dining out,

- Evenings out,

- Gym memberships,

- Subscription services (Netflix, Amazon Prime, Expensive tv packages).

Savings in 50 30 20 budget: This is the amount you should be saving every month. You can use it for other things as well.

- Pay down any debt,

- Build your emergency fund (3 months, then 6 months),

- Build long-term savings and pension funds.

Figure Out Your Total Income Sources.

Before you begin, first figure out your total sources of income. These can include salary from a job, freelance work, investments, rent from real estate and side businesses.

Remember to track any money you make from freelancing or side businesses as well; it’s important for calculating your 50/30/20 budget.

Determining your available funds will help ensure that you are able to pay for all of your necessities and wants, while still having enough left over for savings each month.

List Your Necessities, Financial Goals, and Wants.

After you have your total income and expenses, it’s time to divide them up into the three buckets that make up the 50/30/20 method.

Begin by calculating your necessities, which should account for about 50 percent of your income each month. This includes items such as rent, food, transportation, bills and debt payments.

The next 30 percent should go towards both financial goals and wants like travel or hobbies you always wanted to do.

Finally, the remaining 20 percent is for savings; this money should be put away in savings accounts for emergencies or for long-term goals such as retirement.

Set a Budget Based on the 50/30/20 Rule.

To live within your means and reach financial freedom, start by following the 50/30/20 rule.

Set a budget each month according to this rule that reflects your income, expenses and savings goals.

When you set up a budget, use reasonable estimates for items such as entertainment or travel and if you find that you’re often overspending in certain areas, dedicate more of your budget towards necessities.

It can also help to automate your savings so you don’t forget to put money away every month.

Stick to the Budget and Reassess as Needed.

Once you have your budget in place, it’s important to stick to it and reassess it on a regular basis.

Keeping track of spending and reviewing regular bills, such as credit cards, can help ensure that you are sticking to your budget.

If things change financially, it may be necessary to adjust your budget accordingly.

Lastly, remember to give yourself some flexibility for occasional indulgences, but don’t let them become the norm.