Royal London Life Insurance

Royal London stands out as a premier choice for life insurance within the Irish market, deserving attention during the quote comparison process for your life insurance policy. Royal London Life Insurance DAC delivers an extensive array of competitive and thoughtfully designed products.

They are experts in offering personal protection plans under Royal Life Insurance, designed to shield homes, families, and businesses against financial difficulties in the event of a death.

Contact Us Today

Call 01 853 2727 for your free initial consultation

Benefits Of Life Insurance From Royal London:

Royal London Insurance DAC features an extensive selection of competitive and well-crafted products. They deliver personal protection insurance plans aimed to protect homes, families, and businesses in the event of a death.

How is Royal London different from other insurers?

Under standard terms, Royal London can provide extremely competitive quotes. They include their Helping Hand service as an additional benefit with all policies.

They’ve recently launched their Funeral Helping Hand feature, releasing funds ahead of probate to assist with immediate funeral costs.

Royal London's Dual Life Cover:

Royal London also offers Dual Life cover for the same price as Joint Life cover. (Dual Life cover is not available for Mortgage Protection policies with Specified Serious Illness.)

Royal London's Helping Hand Service:

Helping Hand can offer: Our Life Insurance London policy includes specialist support such as Bereavement Counselling, Speech Therapy, Medical 2nd Opinions, and Complementary Therapies (Massage, Physiotherapy for serious conditions), based on your personal nurse advisor’s recommendation for a limited period. Helping Hand services, part of Life Insurance London, are available with any policy, claim or no claim, at no extra cost. Note that the availability of these benefits may change over time, ensuring comprehensive support tailored to your needs.

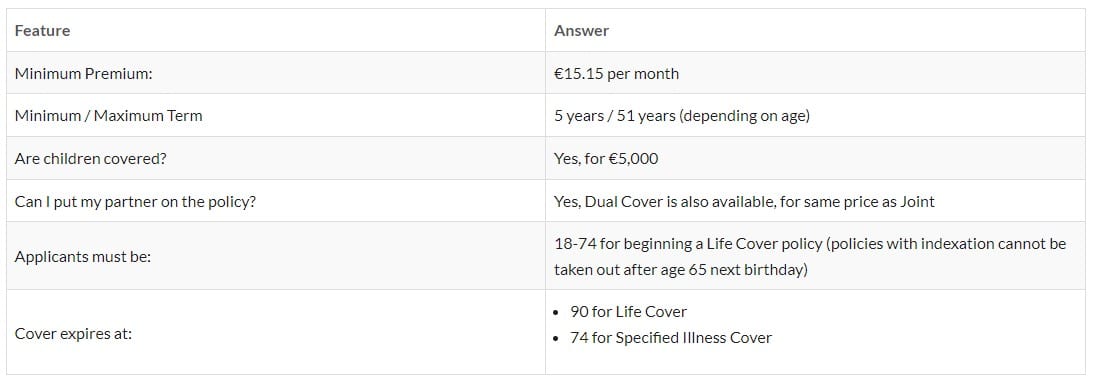

Royal London life insurance FAQ

Specific Illnesses Covered?

- Yes

- 52 full payment illnesses/conditions

- 33 partial payment illnesses/conditions

- For Coronary Angioplasty, (of specified severity), the partial payment will be €50,000 or 50% of cover.

Children's Specific Illness Cover?

- Yes

- The lower of €25,000, or half your cover, on full payment illnesses

- The lower of €7,500, or half your cover, on partial payment illnesses

Is there a Conversion option?

- Yes, (for Life Cover Only policies)

- Max age for Conversion is: 65

Rolling Conversion Option?

- No

Optional Flexibility?

- No

Guaranteed Insurability?

- Yes, maximum age 55 years

Reinstatement?

- Yes

Temporary Accidental Death Benefit?

- No

Terminal Illness Benefit?

- Yes

Waiver of Premium Option?

- No

Other Benefits?

- Royal London Medical 2nd Opinion Service

Royal London Life Insurance

Book a Free 1:1 Initial Consultation

Let’s get on a call to discuss your personal and business finances with our experienced financial planners!

How We Can Help You

Greenway Financial Advisors Limited is regulated by the Central Bank of Ireland. Registered No. C168372