Inheritance Tax Ireland | How To Avoid Legally

This content has been updated to reflect changes in Budget 2025Are you looking for ways to avoid inheritance tax? Inheritance tax is something people forget about until it's too late. In 2018 revenue collected over €466.3 million from inheritance tax payments, but it...

What Taxes Do You Pay On Investments

Are you confused about the taxes you pay on investments? What taxes do you pay on investments. Many investors find it challenging to understand the complexities of investment taxes. In this blog, we'll explain different types of investment taxes, including capital...

Capital Gains Tax Ireland 2026 – Rates, Reliefs, and How to Pay CGT

If you're investing, selling property, or transferring assets, understanding Capital Gains Tax (CGT) in Ireland is crucial. As of 2026, capital gain tax in Ireland remains one of the highest in the EU, making tax planning more important than ever. Whether you’re...

How To Calculate Tax On Pension Income?

Planning for retirement involves more than just saving money; understanding how your pension income is taxed is essential for managing your finances effectively. Taxes on pension income can be complex, but knowing the basics can help you avoid surprises and make...

How Much Do I Need to Retire in Ireland? Complete Guide

Discover how much you need to retire comfortably in Ireland. Learn about retirement costs, state pension, personal savings, and more. Start planning today!

A Simple Financial Planning Framework for Ireland

As we head into a new year, many people in Ireland are setting goals—financial goals often topping the list. Whether you’re trying to save for a home, reduce debt, invest wisely, or plan for retirement, having a financial planning framework tailored for Ireland is...

Organise Your Finances for the New Year 2026

How to organise your finances for the New Year, follow a financial checklist in Ireland, and start the year with clarity and confidence. The New Year is one of the most effective times to reset your personal finances. After Christmas spending, a full calendar year...

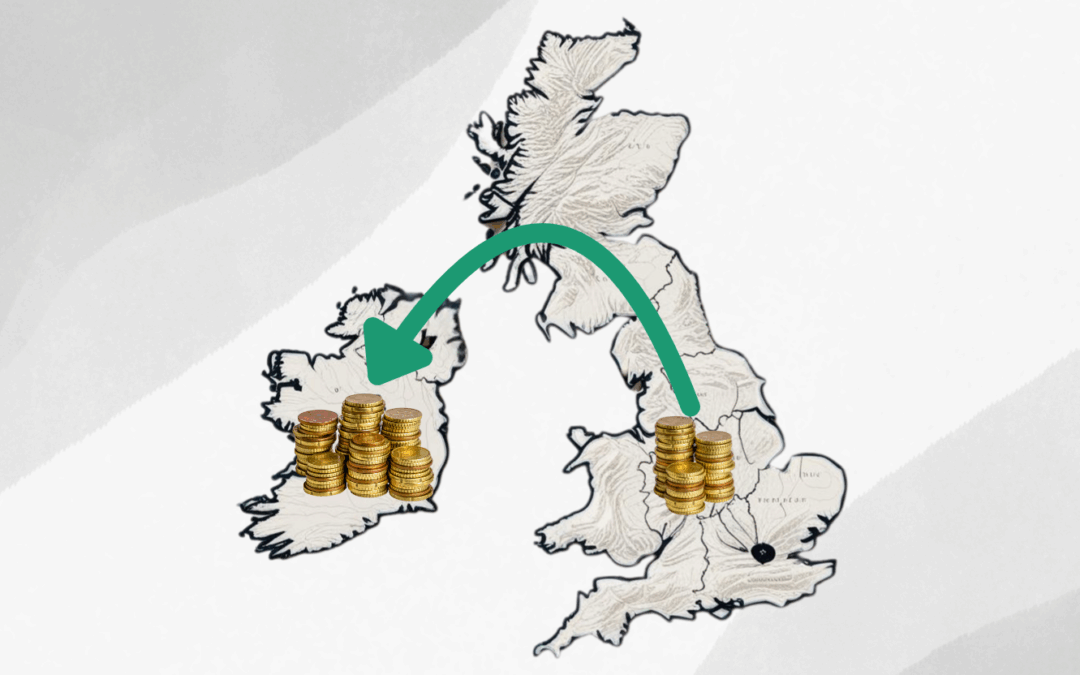

UK Pension to Ireland Your Guide to QROPS Transfers

For many people who have worked in the UK and are now living or planning to retire in Ireland, one key financial question looms: “Can I transfer my UK work or private pension to Ireland?” Please note this does not apply to the UK state pension. The answer is mostly...

How Illness Benefit in Ireland Works: A Complete Guide

If you are unable to work due to illness and meet certain conditions, you may be entitled to Illness Benefit in Ireland. This is a short-term payment provided by the Department of Social Protection (DSP) to help support your income while you recover. In this guide,...

State Savings Options In Ireland

When it comes to safe, government-backed savings solutions, State Savings Ireland is hard to beat. Offered by the National Treasury Management Agency (NTMA) and administered through An Post, these products are 100% guaranteed by the Irish State, free from fees, and,...

Are Pensioners Exempt From Property Tax in Ireland?

The annual Property Tax in Ireland is called the Local Property Tax (LPT). Local Property Tax is charged on residential properties in Ireland. There are no specific local property tax exemptions for pensioners. However, there are a number of deferred options available...