Inheritance Tax Ireland | How To Avoid Legally

This content has been updated to reflect changes in Budget 2025Are you looking for ways to avoid inheritance tax? Inheritance tax is something people forget about until it's too late. In 2018 revenue collected over €466.3 million from inheritance tax payments, but it...

State Savings Options In Ireland

When it comes to safe, government-backed savings solutions, State Savings Ireland is hard to beat. Offered by the National Treasury Management Agency (NTMA) and administered through An Post, these products are 100% guaranteed by the Irish State, free from fees, and,...

Are Pensioners Exempt From Property Tax in Ireland?

The annual Property Tax in Ireland is called the Local Property Tax (LPT). Local Property Tax is charged on residential properties in Ireland. There are no specific local property tax exemptions for pensioners. However, there are a number of deferred options available...

Capital Gains Tax Ireland 2025 – Rates, Reliefs, and How to Pay CGT

If you're investing, selling property, or transferring assets, understanding Capital Gains Tax (CGT) in Ireland is crucial. As of 2025, capital gain tax in Ireland remains one of the highest in the EU, making tax planning more important than ever. Whether you’re...

Best Savings Account Ireland 2025 – Where to Get the Highest Rates

If you’re wondering about the best savings account in Ireland are you’re not alone. With interest rates are changing and more savings products available, choosing the right savings account in Ireland has never been more important. Whether you’re planning for a...

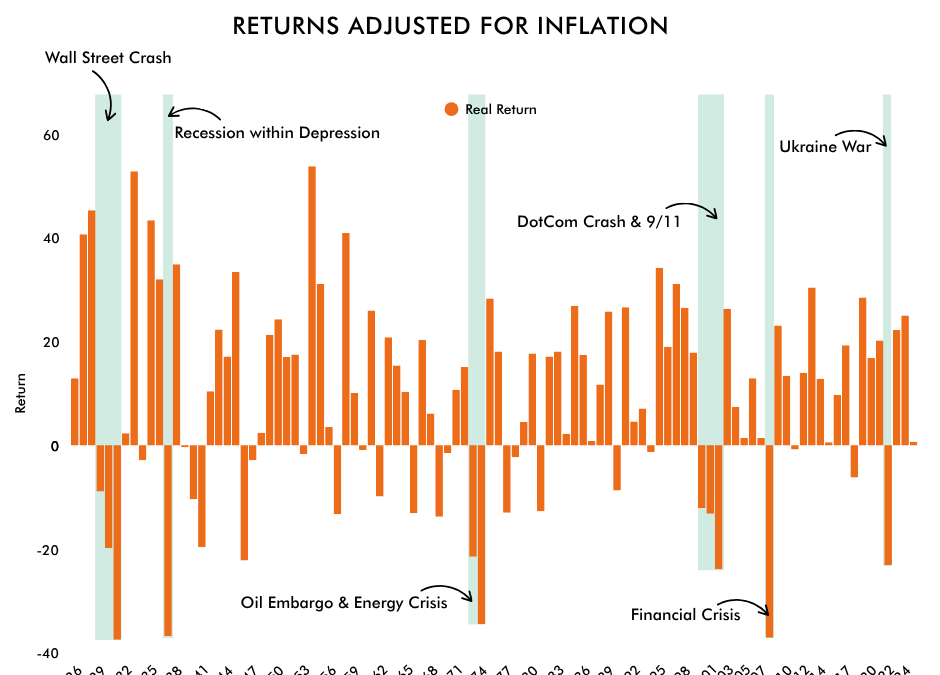

Investing Amid Volatility: A Long-Term Guide for Irish Investors

In recent months in particular, financial markets have seen considerable volatility. Global economic uncertainty, interest rate adjustments, and geopolitical tensions have all contributed to dramatic market swings. For many investors and pension savers, these...

Why Financial Advice Matters More Than Ever in 2025

In today’s unpredictable economic climate, more Irish consumers are turning to Financial Brokers for expert guidance — and it’s paying off. The newly published Value of Advice Report 2025 by Brokers Ireland shows just how much professional financial advice can...

What Are the Best Financial Tips for Your 20s?

Your 20s are an exciting time filled with new experiences! But they’re also the perfect stage to set a solid financial foundation. Making smart financial choices early on can lead to greater security, freedom, and opportunities in the future. It might seem challenging...

New Pension Rules 2025 for Company Directors

The Irish government’s Finance Bill, published on 11 October 2024, introduces key updates to pension rules that are set to take effect in 2025. These changes impact Personal Retirement Savings Accounts (PRSAs), employer contributions, and also bring in auto-enrolment...

What’s the Difference Between Income Protection and Critical Illness Cover?

Life can take unexpected turns, and when illness or injury comes, it’s essential to have the right financial protection in place. To help you prepare for these challenges, two common types of coverage can provide peace of mind: Income Protection and Critical Illness...