Auto Enrolment Pensions For Employers

Updated with new auto enrolment information Janurary 2025If you're an employer in Ireland, from 2025 you will have a legal obligation to automatically enrol eligible employees into the new auto-enrolment pension scheme if the employee is not already in an existing...

5 Tips You Need to Ask About Money

Do you feel like you have no control over your money? Knowing the right questions to ask about money is the key to taking control of your finances. From budgeting to saving for retirement, these 5 essential questions to ask about money management will help you take...

What is business management?

Business management is a term lots of people search for. But what are they really looking for? Business management is the practice of leading a team or organisation to achieve success in the marketplace. It involves planning, organising, and directing the activities...

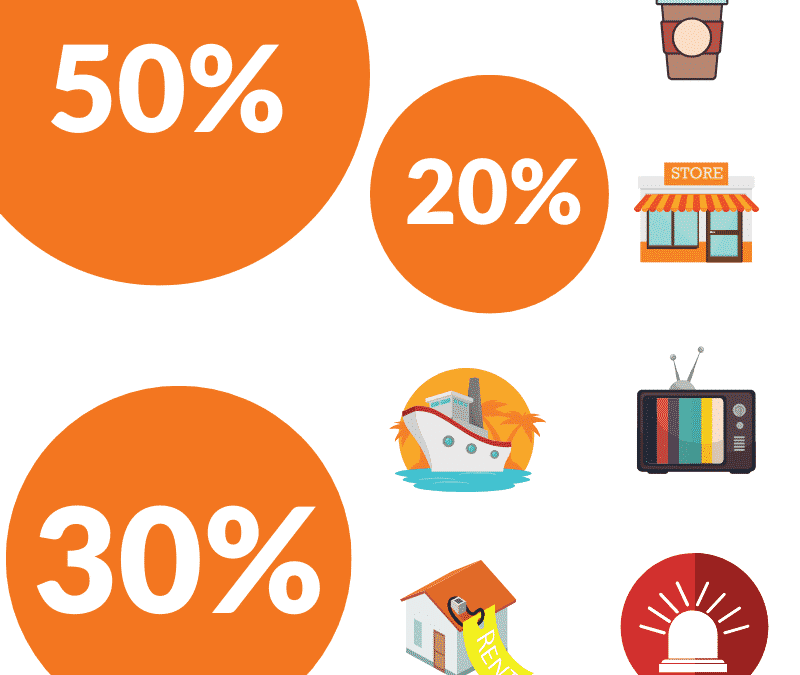

Achieve Financial Freedom Using The 50/30/20 Money Management Method

If you’re looking for a simple and easy way to budget your money, the 50/30/20 money management method may be perfect for you. This technique prioritizes needs over wants and could help you achieve financial freedom in no time. Learn how this strategy works and manage...

How Much is The State Pension in Ireland?

As retirement approaches, one of the most pressing concerns is income. In Ireland, the state pension provides a regular source of income in later life. Understanding how much to expect is important when planning for the future. The amount paid out by the Irish state...

Business advice for construction: Electrician | How our advice helps

Our business advice service offers business owners a long-term supportive environment to develop their business. Greenway works with the business owner to build structures and procedures that will increase profitability, sales and turn your business into a powerhouse....

MAXIMISE YOUR PENSION CONTRIBUTIONS IN IRELAND

Maximising your pension contributions in Ireland is a great way to provide you with an appropriate income for your retirement while reducing your tax bills. Indeed, it helps you invest a suitable amount of money into your pension and allows you to save money on taxes...

How to budget your money?

No matter what your financial situation is, knowing where your money is going each month is essential. Having a budget helps you be more in control of your finances and let you save money in the short and long term. Here is how you can budget your money easily: 1....

Best Ways to Reduce Income Tax In Ireland

Are you self-employed in Ireland? And, filing your income tax return every year? And want to know how to pay less tax as a self-employed person? This article is for you. If you want to save money on your taxes next year, know that there are many ways to do it. Filing...

Early Retirement in Ireland – Achieve Financial Freedom

In Ireland, people generally retire at 66 because it’s the current age at which they qualify for the state pension. However, in the coming years, the retirement age is most likely to increase, and you might have to work until at least age 67. Early retirement is a...