Contact Us Today

Call 01 853 2727 for your free initial consultation

About Irish Life Pensions

For over 80 years, Irish Life pensions have helped people in Ireland embrace change and build better futures through its innovative products and dedication to customer care.

Irish Life provides pension plans to its clients in two ways:

- They have a Retail Division that deals with the public directly, and through brokers.

- They have a Corporate Division which deals with businesses.

And Irish Life pensions work with Brokers & Financial Advisors, who help businesses and individual customers. Your work pension might be with Irish Life, for example, even though you only deal with your employer when you want to make changes.

Benefits of Irish Life Pensions

- Secure in knowing your investment is with a strong AA-rated business.

- Get tax relief on your pension contributions.

- A monthly contribution of €200 will only cost €160 after 20% tax relief.

- A monthly contribution of €200 will only cost €120 after 40% tax relief.

- Wide range of investment options.

- Increase or decrease your contributions at any stage.

- Payment breaks if you need to stop contributions.

- Make once-off annual contributions.

- Set up personal pensions, Personal Retirement Savings Accounts (PRSA), or Personal Retirement Bonds (PRB).

Pension Tools

Pension Calculator

Use our custom pension calculator to see what your income in retirement could be and the amount of tax you can save.

Pension Tax Relief Calculator

Use our pension tax relief calculator to learn how pension tax relief works and the amount of income tax you can save.

Maximum Pension Contribution

There are limits on what you can invest in your pension. Find out what your maximum pension contribution is.

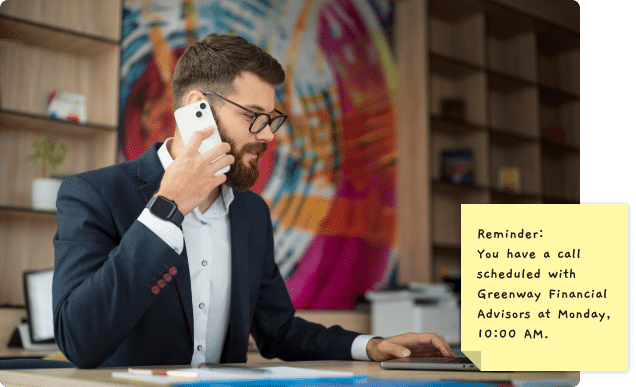

Book a Free 1:1 Initial Consultation

Let’s get on a call to discuss your personal and business finances with our experienced financial planners!

How Irish Life Pensions Work

Contact Us To Start

Our qualified financial advisors will talk to you about your current financial situation, your future financial plans and what income in retirement you would like.

We’ll complete an attitude to risk assessment to make recommendation on what Irish Life pension product and fund would suit your life conditions.

Setting Up Your Pension

Once we’ve answered all your questions and you’ve made your choice on what pension you want, we’ll do all the paperwork to get your Irish Life pension opened.

All you’ll have to do is provide your information, and digitally sign the application forms. Greenway works fully online saving you time and complications in getting your Irish Life pension set up.

Your Pension Is Running

Irish Life pensions have logins for their secure online portal. Here, you can make changes to your Irish Life pension and monitor the growth of your fund.

If you need any help, or advice on making changes we’re here to answer your questions and provide advice.

We’ll contact you once a year to see how you are and if you have any questions.

Frequently Asked Questions

What is a Pension?

A pension is an investment fund in which a pension member makes contributions during their lifetime. The goal is to save money in the long run and then use that money as income after retirement.

How do pensions grow?

Your pension contributions are invested in a wide range of funds. As the fund performance goes up and down, monitored by the fund managers, your pension value changes.

This gives your fund a great chance to beat the low rates of deposit interest, and reduce the effect of inflation on your pension.

You have full control of the level of risk of your fund. Normally the higher the risk level of the fund the higher the growth. However higher levels of risk mean you’ll have greater volatility meaning your investment may lose money as well.

Growing your pension - income tax relief

When you’re saving and building your pension fund through monthly contributions or annual contributions you save on income tax. This makes a pension the best value long-term savings product.

Example 1:

35 years old earning €35,000 per year.

Contributing €200 gross every month into a pension.

After tax reliefs this only costs €161 per month.

Saving €40 on every contribution (20% saving).

Example 2:

45 years old earning €50,000 per year.

Contributing €200 gross every month into a pension.

After tax reliefs this only costs €118 per month.

Saving €78 on every contribution (39% saving).

Example 3:

55 years old earning €50,000 per year.

Contributing €300 gross every month into a pension.

After tax reliefs this only costs €180 per month.

Saving €120 on every contribution (40% saving).

Growing your pension - tax-free growth

Your fund grows tax-free until you take your pension benefits. This is the only kind of investment account that can do this.

On retirement - tax-free lump sum

When you retire, you can take a tax-free lump sum of up to 25% of your fund.

You then decide to invest the remaining funds in an Approved Retirement Fund (ARF) or an Annuity.

On retirement - ARF or annuity?

When you retire you need to decide what to do with your pension fund.

You can take the money from the fund, but you will have to pay income tax on anything above the 25% tax-free lump sum amount. This will remove all the good you did in building your fund in the first place!

Luckily there are 2 other options available to you.

Option 1: Approved Retirement Fund (ARF)

An ARF is a post-retirement investment fund. The goal of the fund is to continue to grow the money you invest in the ARF. Like pensions, there is no tax on the growth of the fund.

You can access your funds in a flexible manner and many people with ARFs withdraw the growth gained in the calendar year leaving the balance to grow again the next year.

You do pay income tax, USC and PRSI (if applicable) on any withdrawals from your ARF.

Option 2: Annuity.

An Annuity is a regular income for the rest of your life. It provides a guaranteed income for your retirement. It is a lifetime income attached to one person. Annuities can be a good option for those who want a guaranteed income, but be careful when exploring how these are inherited by spouses.

What Products do Irish Life Pensions offer?

Pre-Retirement – While You’re Working & Contributing To Your Pensions

- Personal Retirement Savings Accounts (PRSAs)

- Personal Pensions

- Personal Retirement Bonds

- Corporate Pensions

How Can I Check On My Irish Life Pension?

If you’re an active member of the pension (still in that job or contributing to the plan), then you receive the following info:

- Basic Scheme Information when you join.

- Info about your investment choices & default investment options.

- Statement of Reasonable Projection.

- Notice of changes to your company scheme within 4 weeks of the change.

- Investment info & Statement of Investment Policy Principles every 3 years.

- Personal Benefit Statement every year.

- Personalised Information when you leave a scheme.

- Annual Reports for company pension schemes

If your company pension is managed by Irish Life, you’ll either contact your company for changes or contact Irish Life directly.

Many members of company schemes also use Irish Life’s online system to log in and check their pension details.

Post-Retirement – When You’ve Retired OR Taken Your Benefits

- Approved Retirement Fund (ARF)

- Approved Minimum Retirement Fund (AMRF)

- Annuities

Irish Life Pension Fund Management

The funds offered by Irish Life are managed by:

- Irish Life Investment Managers (ILIM)

- Setanta Asset Management

- Amundi Asset Management

Your Path to Personal and Company Pensions

Personal Pensions

Irish life provides a number of great personal pension options. If you want to find out more about Irish Life flexible pensions contact us today. You can opt for a Personal Pension Plan, a PRSA (Personal Retirement Savings Account) and more. A personal pension is a great option that gives you control, flexibility and choice in how to grow your pension and protect your retirement.

Company Pension

If you are running a business and need help on setting up company pension plans we’re here to help. Pensions are tax efficient ways of helping ensure your employees are financially secure in retirement. Our team will guide you and your employees through the process of setting up their pensions and will guide your payroll department in how to process payments.

About Greenway Pensions

At Greenway, we bring together our knowledge, experience and efficiency to our customers. We’ll help you find the right path or products, and even better, you’ll know why, and how to use it.

Our financial advice is tailored to each individual needs and situation. Our goal is to help our customers reach financial independence and better their lifestyles.

Most importantly, your policy or plan should fit your life, and your financial advisor should fit into your lifestyle.

We build long term relationships with our customers. As your life circumstances change we will be there to advise you about changing and adjusting your policies.

- Warning: Past performance is not a reliable guide to future performance.

- Warning: This product may be affected by changes in currency exchange rates.

- Warning: The value of your investment may go down as well as up.

- Warning: If you invest in this product you may lose some or all of the money you invest.

Greenway Financial Advisors Limited is regulated by the Central Bank of Ireland. Registered No. C168372