Secure Your Financial Future

Financial Advisor Dublin – Financial Advice You Can Trust

Helping individuals, families and business owners across Dublin make informed financial decisions through clear, financial advice and regulated financial products.

Regulated by the Central Bank of Ireland

Qualified Financial Advisors

Personal & Business Financial Advice

Financial Advisory Services for Dublin Clients

Pension Advice

Planning for retirement is one of the most important financial decisions you will make.

We provide pension advice to help you understand your options and build a retirement plan aligned with your goals.

Investment Advice

Protection Planning

Personal Advice

Affordable Financial Planning For Individuals & Families

Pension for Businesses

Pensions For Self Employed And Company Directors

Business Management

Our 7 steps program to improve profit

Client Testimonials

Our Financial Advice Process

1. Initial Consultation

2. Assessment & Planning

We review your options and outline suitable financial strategies.

3. Clear Recommendations

4. Ongoing Support

We remain available to review and adjust your plan as circumstances change.

Financial Advisor Dublin – Frequently Asked Questions

What does a financial advisor in Dublin do?

A financial advisor helps individuals and businesses plan their finances by providing advice on pensions, investments, protection and long-term financial planning.

Are Greenway Financial Advisors regulated?

Yes. Greenway Financial Advisors is regulated by the Central Bank of Ireland in relation to the provision of regulated financial products, including pensions, investments, and protection policies.

Financial planning consultations and written financial planning reports are not themselves regulated financial products.

However, they are delivered in line with recognised financial planning standards and the professional guidelines associated with the Qualified Financial Adviser (QFA) designation.

How much does financial advice cost in Ireland?

Your initial call is free of charge. If we believe our services can assist you, we will clearly explain the scope of work and confirm the total cost in advance.

Where financial advice is provided, we charge a fixed fee. This is calculated based on our hourly rate and the time required to complete the work.

For financial products, clients may choose to pay our fees directly or to have remuneration paid by way of commission from the product provider.

Any quotation provided by a product provider will clearly disclose the intermediary commission payable to us, including how much we are paid over the lifetime of the product.

What will I need to get my plan?

Generally, we look for bank account statements, annual & monthly costs, pensions statements and other information rela

Do you offer an initial consultation?

Yes. We offer an initial consultation to discuss your financial goals and how we may be able to help.

We will only recommend services where we believe they can genuinely improve your long-term financial security.

There is no obligation to proceed with our services following the initial consultation.

Trusted By Leading Providers

Financial Advice For Individuals & Businesses

Financial advice is the process of helping people make informed decisions about their money. It can encompass everything from creating a budget to investing for retirement.

They typically have expertise in one or more financial areas, such as financial planning, insurance, mortgages or investment. They go through your financial life with you and give you advice and recommendations on making more efficient use of your money and making a financial plan to help you achieve the goals you have set for yourself.

Also, they should look at the financial risk to your family and review the insurance protection you have in place.

A financial advisor should be qualified and, if selling or advising on regulated financial products, be regulated by the Central Bank of Ireland. Don’t be afraid to ask about their qualifications and their Central Bank registration number.

Contact Us Today

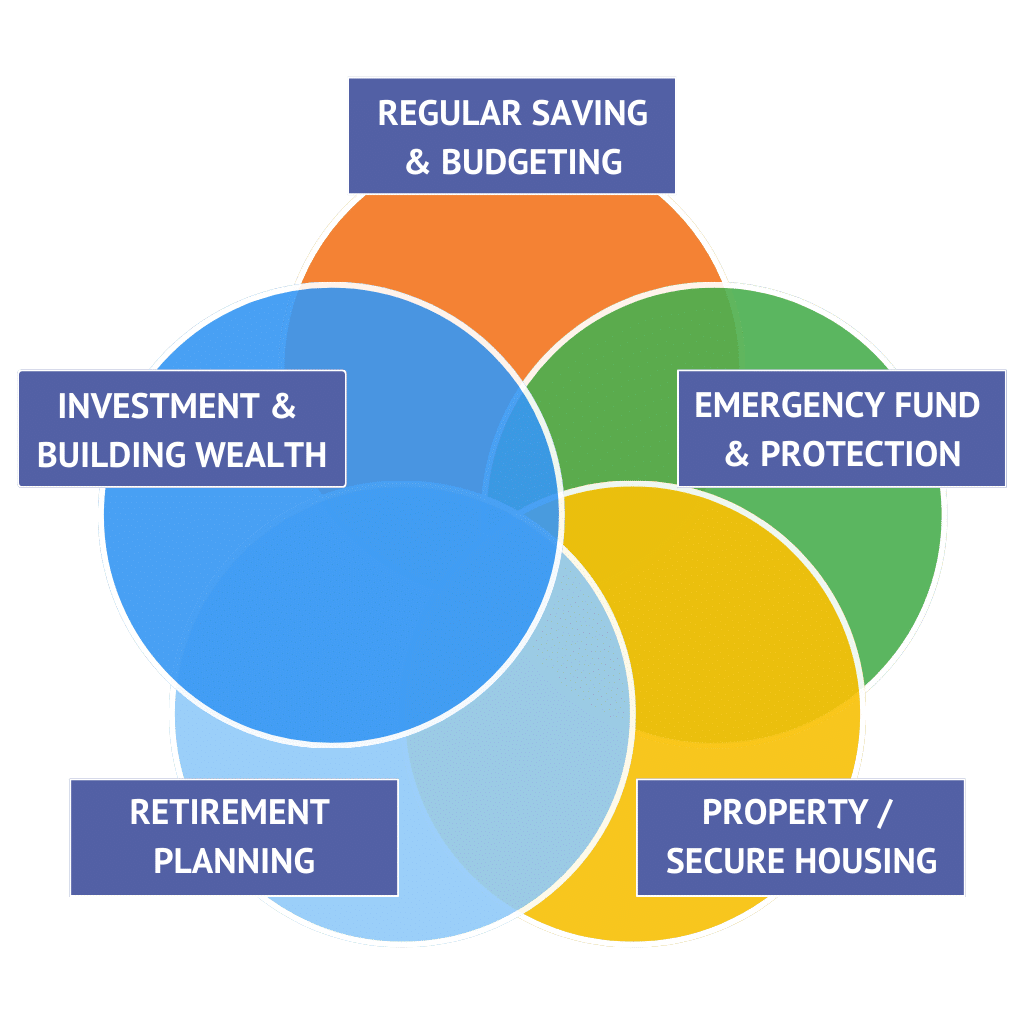

Benefits of Financial Planning

Financial planning is the key to securing your financial future, and this guide provides everything you need to know about setting yourself up for long-term success.

Before you start putting together a financial plan, it’s important to know exactly where you stand financially. Evaluate your income, assets and liabilities, so that you have a clear picture of your current financial situation.

News & Stories

Best Ways to Reduce Income Tax in Ireland For Self Employed

Are you feeling stressed by the amount of income tax you pay each year and looking for effective ways to reduce it? Paying income tax is a necessity, but understanding how to minimise your tax liability can significantly impact your financial well-being. Many...

The Ultimate Guide to Auto Enrolment for Pensions

Welcome to The Ultimate Guide to Auto Enrolment for Pensions: Everything You Need to Know. Are you unsure about the complexities of pension schemes and how auto enrolment works? Look no further! In this comprehensive guide, we'll walk you through the ins and outs of...

APRC VS Interest Rate: What’s the Difference?

APRC & Interest Rates On Mortgages Understanding APRC vs Interest rate is essential for knowing what you are being charged on your mortgage. Your mortgage is likely the most significant financial commitment you will ever make, so it's essential to understand the...

Pensions in Ireland: Why They’re a Smart Choice

Pensions in Ireland are one of the most effective ways to secure your financial future. A pension isn’t just about planning for the future—it’s also about making smart financial decisions today. With tax savings, investment growth, and financial security, pensions are...

Self-employed pensions

Self-employed pensions are designed for individuals who work for themselves. As a self-employed individual, it is essential for you to think about retirement and plan for the future. Because you’re not an employee, you can’t benefit from an occupational pension. When...

How We Can Help You

How Our Financial Planner Can Help You?

Our financial planner will do a review with you called the Fact Find to establish: What are your financial goals and dreams? What is your current financial position, and how do they match your plans? Do you own your own home? If not, do you plan to purchase one? Are you financially protected if anything goes wrong? What plans have you made for your retirement?

When you have provided all this information, we will then prepare a plan and recommendations based on your information. We will make recommendations to cover the highest risks first and the amount of money you can afford because it’s much better to be realistic about your current finances and make a plan.

So make a decision, get a sound advice – make a plan, and you will feel a lot better.

Greenway Financial Advisors Limited is regulated by the Central Bank of Ireland. Registered No. C168372