IS MORTGAGE PROTECTION WITH A BROKER DIFFERENT TO MORTGAGE PROTECTION FROM THE BANK?

Online brokers can help make you some significant money and time savings on your mortgage protection. There are a number of key differences between your online broker and your bank when you’re shopping for mortgage protection.

The most important one to remember is your broker works for you. We offer mortgage protection advice based on your whole life circumstances and look to build life-long relationships.

The second thing to remember is that your broker will arrange an individual policy, for you specifically. Your bank or mortgage lender will offer you access to a group policy owned by them.

Personal Qualified Service

With Brokers, there is a higher probability you will talk to the same person through the whole process. From getting your mortgage protection quote or life insurance quote, filling in your application and getting your policy document sent, this means you won’t bounce around a call centre with your queries.

Our staff of fully Qualified Financial Advisors (QFA, LIA) are trained not to focus on selling you a product, but to advise you on the best course of action for you and your family.

Why Get Financial Advice?

When you have a big decision to make, or your life is changing there’s a lot to think about.

Impartial professional financial advice helps you make a better decision that gives you better options and saves you money for the rest of your life.

How we can help you

- Get life insurance for a mortgage in Ireland

- Get your personal financial plan in place.

- Increase your monthly & annual savings.

- Plan for a secure retirement.

- Buying a home or investment property.

- Protecting your family.

- Life insurance in Ireland

Open When It Suits You

Online brokers work the exact same way as high street brokers, but we work when it suits you. Greenway is open from 9:00am to 9:00pm, Monday to Saturday, to answer any questions you may have.

The benefit of using online brokers that are open longer hours is that you can complete your mortgage protection or life insurance application from the comfort of your own dining table/sofa/car – wherever suits you. No having to book time off work or sneaking out to take personal calls. Just call us when your day is finished!

Mortgage Protection Offers

When your bank gives you a quote for mortgage protection, they are only offering you a price from one provider. The sales advisors that you deal with for these group policies are called tied agents, meaning they deal with one insurance company exclusively.

For example Bank of Ireland exclusively offers Mortgage Protection policies from New Ireland Assurance. (Correct at time of writing 15/04/2019). This means Bank of Ireland can only offer mortgage protection through New Ireland.

Mortgage Protection Offers

When your bank gives you a quote for mortgage protection, they are only offering you a price from one provider. The sales advisors that you deal with for these group policies are called tied agents, meaning they deal with one insurance company exclusively.

For example Bank of Ireland exclusively offers Mortgage Protection policies from New Ireland Assurance. (Correct at time of writing 15/04/2019). This means Bank of Ireland can only offer mortgage protection through New Ireland.

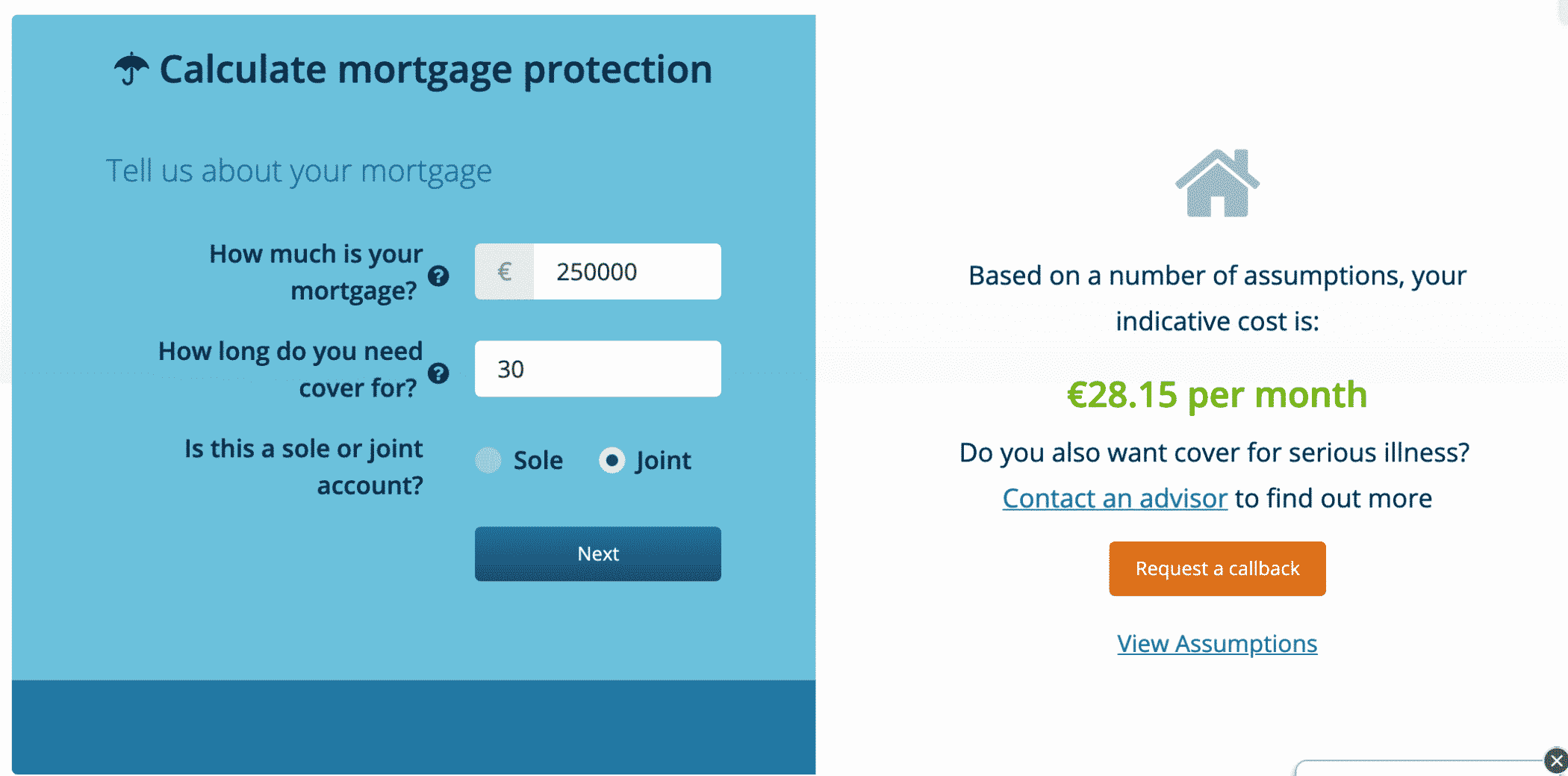

| Information | Coverage Amount | Monthly Price |

| Two Lives, Non-smokers | €250,000.00 | €28.15 [New Ireland] |

| Date Of Birth: 01/01/1985 | Term: 30 Years |

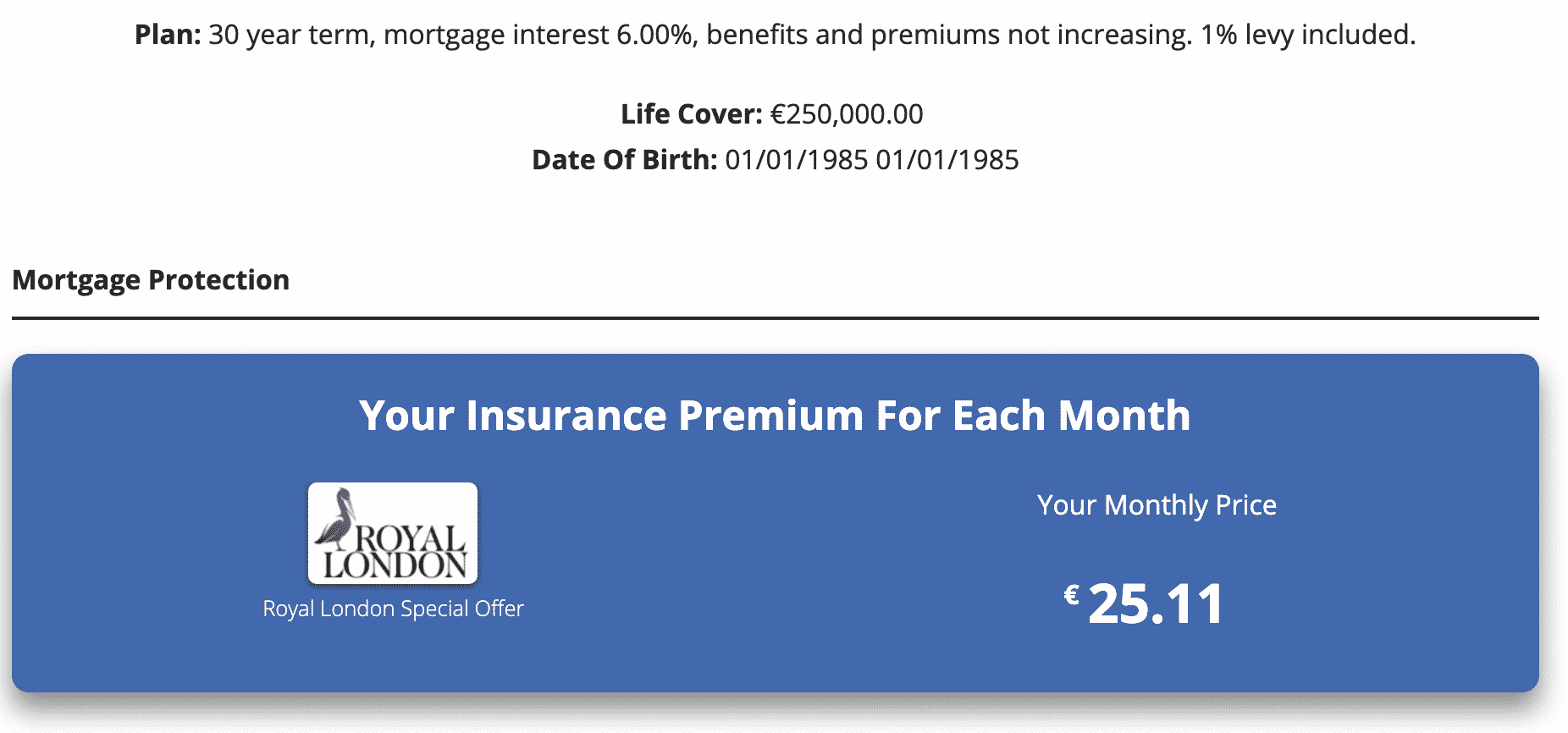

| Information | Coverage Amount | Monthly Price |

| Two Lives, Non-smokers | €250,000.00 | €25.11 [Royal London] |

| Date Of Birth: 01/01/1985 | Term: 30 Years |

Using the example above an online broker could save you over €1000.00 on the lifetime of this mortgage protection.

Online brokers can offer you products from all major Irish insurers with whom they have agency agreements. This type of Insurance Intermediary is called an Insurance Agent or Broker. This means that they can give a fair analysis of the market. Currently Greenway can offer products from a number of insurance providers.

Because Online Brokers can offer more products they may be able to match something better to your life circumstances. There are subtle differences between each insurer’s products, and we can advise you.

Quick Application Process

In some cases where the mortgage protection or life insurance application has no outstanding medical requirements we can often get policies approved within 24 hours of receiving the full application. You can fill in our online application form anytime during the day or night, and once one of our qualified financial advisors reviews and submits it to the insurer we will know how long approval will take.

Debbie Cheevers

Qualified Financial Advisor

Debbie was born in Dublin and graduated from NCAD with a degree in Visual Communication. She brings a strong customer service background to Greenway.

Debbie qualified as APA in 2017 and a fully qualified financial advisor (QFA) in 2018. She believes that product knowledge is key to helping customers make the right choices.

In 2022 Debbie gained a tax qualification as a Technician Member of the Irish Taxation Institute.