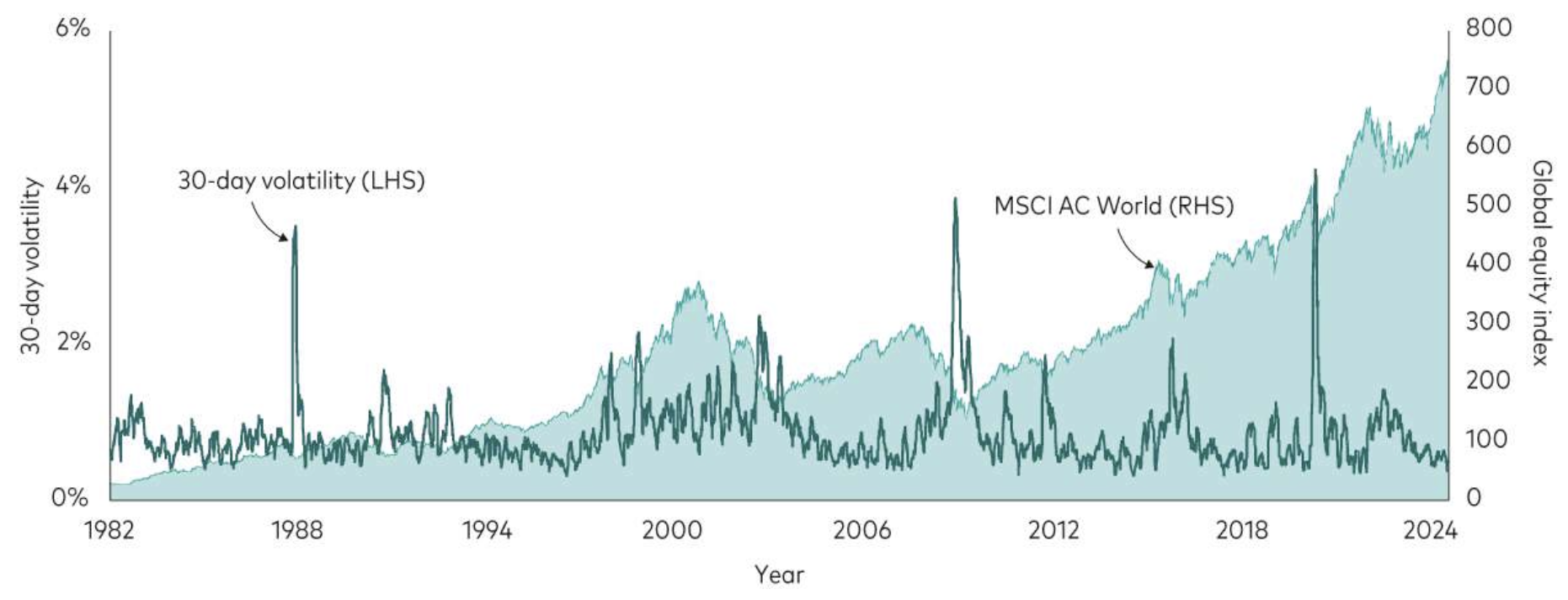

Market volatility is an inevitable part of investing, but that doesn’t make it any less stressful for clients.

As financial advisors, it’s our role to provide perspective, keep clients focused on long-term goals, and help them avoid emotional decision-making.

We’ve highlighted five points that can offer reassurance and a broader view of market volatility and turbulence.

Book Meeting

Let’s get on a call to discuss your business with our experienced financial advisors!

Book Meeting1. Market Declines Are Normal And Temporary

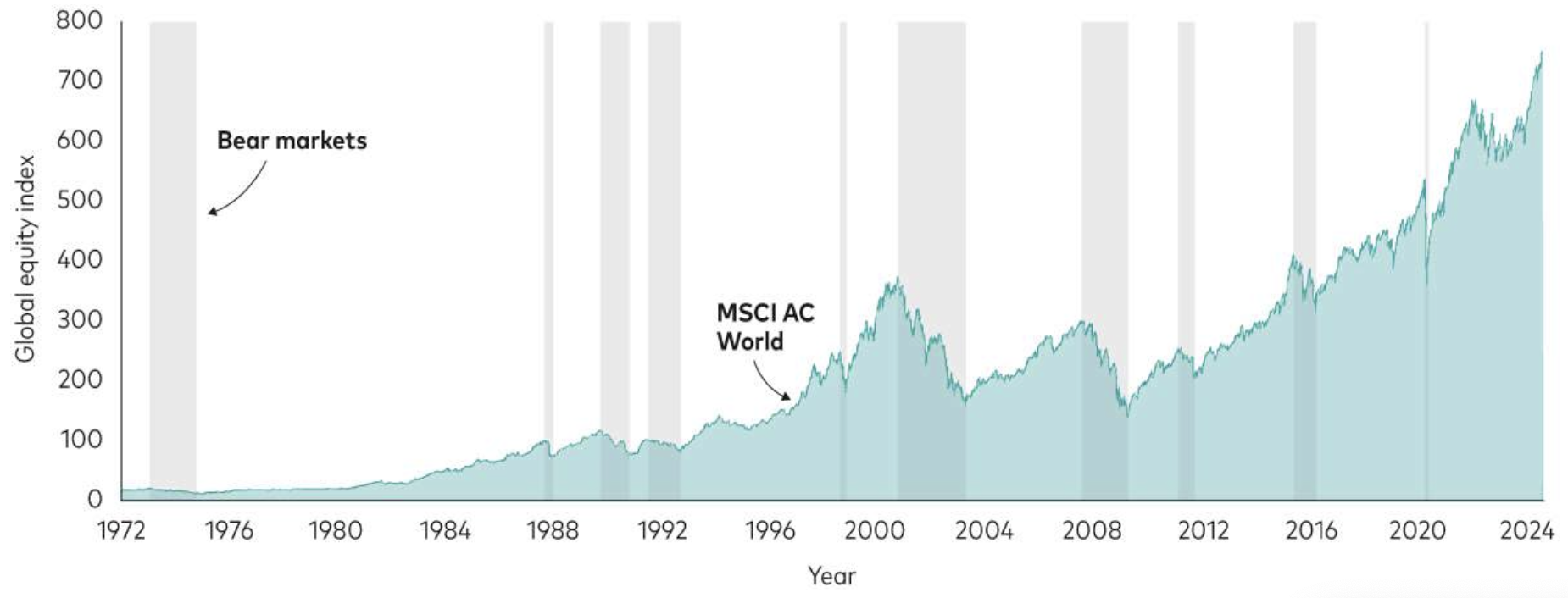

Bear markets and corrections are part of life for anyone who invests into equities. You are best taking a long term focus.

Since 1972, there have been ten bear markets in global equities, from a euro investor’s perspective. History shows that equities typically recover and go on to post strong results over the long term.

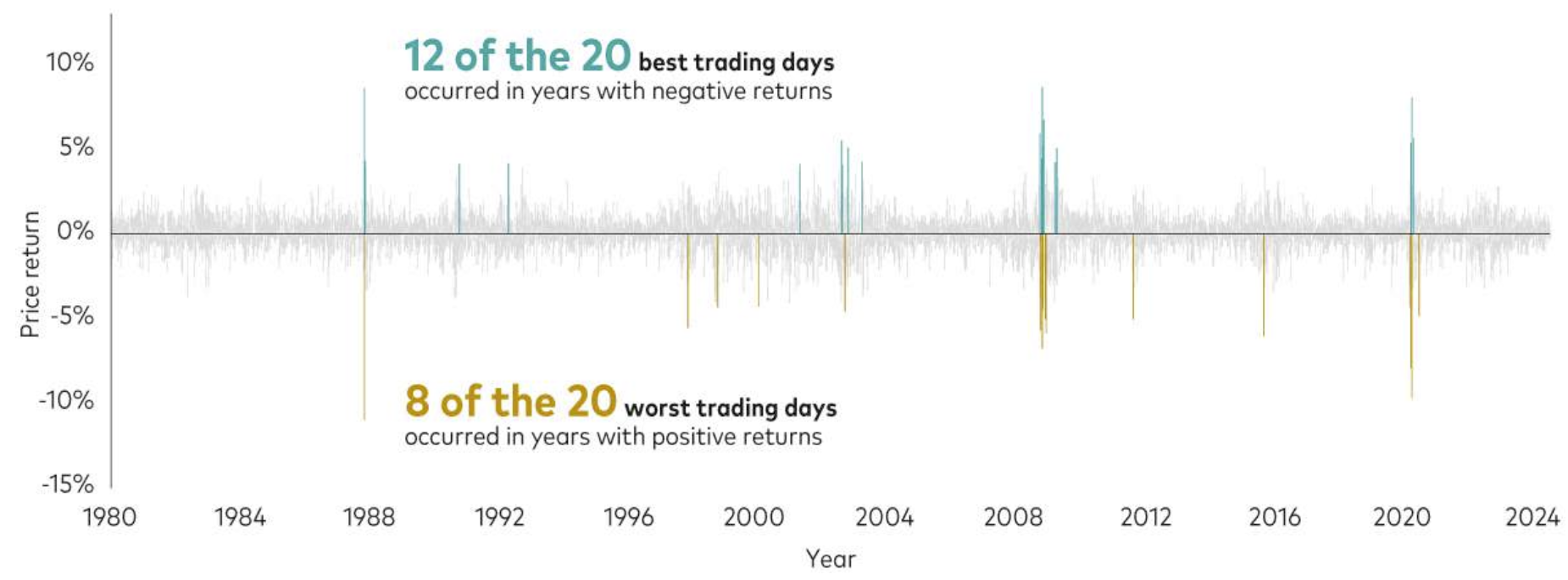

2. Time In The Market Beats Timing The Market

Attempting to time the market is a risky strategy that often leads to missed opportunities. Some of the best and worst trading days often happen close together.

Data suggests that remaining invested—even during downturns—yields better long-term results than trying to jump in and out of the market.

Missing just a few of the best-performing days can significantly impact returns, reinforcing the importance of a disciplined investment approach.

3. Diversification Mitigates Risk

4. Staying The Course Leads To Long-Term Success

Despite short-term setbacks, patient investors who stick to their financial plans are often rewarded over time.

Reviewing historical data on portfolio performance over various time horizons highlights the benefits of maintaining a long-term perspective, even during turbulent periods.

5. What To Do Before Volatility Hits

Make a Plan & Review It Annually: Before market volatility strikes, develop a strategy for managing downturns.

Regularly reviewing your plan—at least once a year—is essential, especially if you rely on investments for retirement income or have upcoming financial needs, such as funding a child’s education or preparing for retirement.

Ignore the Noise: If you have a solid financial plan in place and have reviewed your investments, stay the course.

Avoid the temptation to react emotionally to market fluctuations or obsess over falling prices.

Reassess Your Risk Tolerance: If market volatility is causing significant stress, it may be time to reevaluate your risk tolerance. Adjusting your asset allocation can help align your portfolio with your comfort level.

Set Realistic Expectations: Base your return expectations on long-term historical data rather than exceptional market years. This will help you maintain a balanced perspective during market ups and downs.

Maintain Diversification: A well-diversified portfolio helps mitigate risk. Ensure your investments are spread across asset classes—such as equities and bonds—and diversified geographically. When some markets decline, others may rise, helping to minimise losses.

Get Advice: Good financial advice helps you avoid mistakes, be more tax efficient and can improve performance. Contact Greenway Financial Advisors now to book a free initial call.

- Warning: Past performance is not a reliable guide to future performance.

- Warning: This product may be affected by changes in currency exchange rates.

- Warning: The value of your investment may go down as well as up.

- Warning: If you invest in this product you may lose some or all of the money you invest.

The information provided is for general purposes only and does not constitute financial advice.

Always consult a qualified financial advisor who is registered with the Central Bank of Ireland for personalised guidance.