In recent months in particular, financial markets have seen considerable volatility.

Global economic uncertainty, interest rate adjustments, and geopolitical tensions have all contributed to dramatic market swings. For many investors and pension savers, these fluctuations can feel unsettling.

However, it’s precisely during such periods that the importance of a long-term perspective becomes clear.

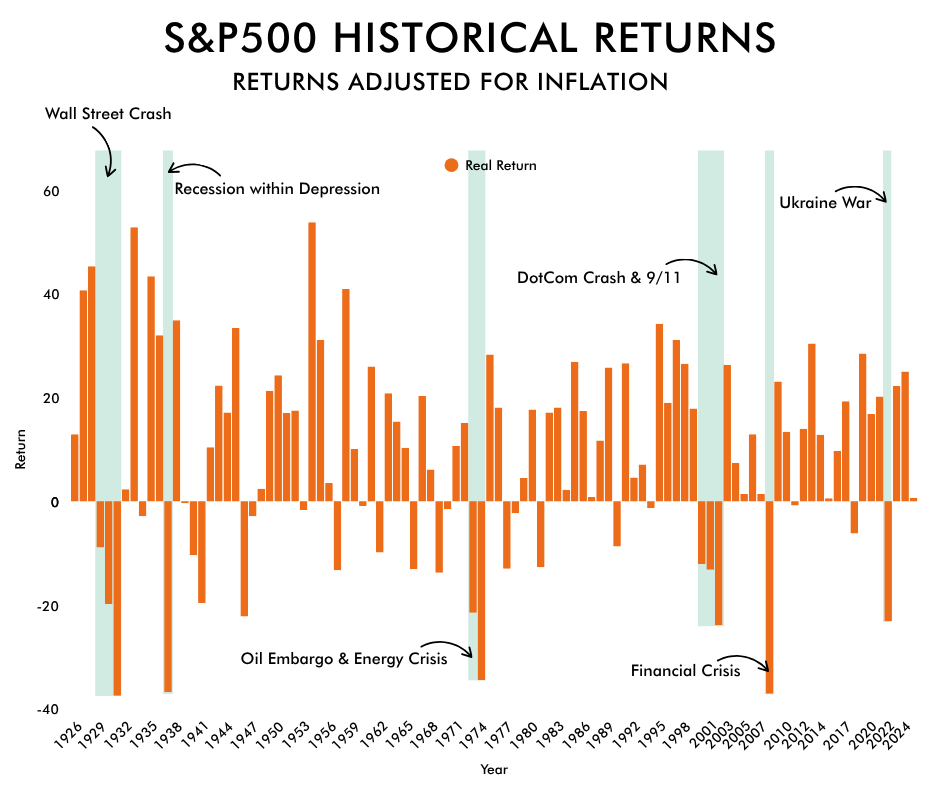

Understanding how financial markets—like the S&P 500—have historically performed can offer valuable reassurance.

After all, successful investing and building pension funds is often about time in the market, not timing the market.

Looking Back: What History Tells Us

Historically, the S&P 500 has averaged annual returns of about 10% before inflation. The index has weathered major events such as:

- The Dot-com Bubble (2000–2002).

- The Global Financial Crisis (2007–2009).

- Ukraine War (2022).

Each time, the index rebounded and continued to grow, reinforcing the case for long-term investing and building pension funds.

For those planning for retirement, the S&P 500 has traditionally served as a solid cornerstone for long-term savings and investments within a diversified pension portfolio.

However, for individuals approaching retirement—typically within the next 5 to 10 years—or already drawing a retirement income, the associated market volatility can pose challenges and may necessitate a more cautious investment strategy.

Today’s Market: Caution and Opportunity

As of mid-2025, the S&P 500 is navigating a complex economic environment with factors such as:

- Moderating inflation.

- Potential interest rate cuts from central banks.

- Stronger-than-expected corporate earnings.

-

Heightened uncertainty due to escalating trade tensions and tariffs, particularly involving the United States and its key trading partners.

Need Financial Advice

If you need any financial advice contact us now. We offer a no obligation initial call.

Actions for Today’s Investors & Pension Savers

1. Diversify Your Portfolio

Don’t rely solely on U.S. equities. Include other asset classes such as bonds, property, and international investments to reduce risk and enhance returns—particularly important when building a balanced pension fund.

2. Rebalance Regularly

With markets rising, equity allocations may exceed your risk tolerance. Rebalancing helps maintain your planned mix of savings and investments, including those within pension structures.

3. Invest for the Long Term

Stick to a well-thought-out plan. Market dips can be unsettling, but historical data supports staying the course for your investment goals, especially when building pension funds for future income.

4. Use Tax-Efficient Strategies

Consider maxing out pension contributions to benefit from tax relief and long-term savings growth. This is one of the most effective ways to build a substantial pension fund.

5. Review Protection and Estate Planning

Especially in volatile times, ensure your life cover, income protection, and wills are in order—important safeguards for your family and financial savings, particularly if your pension fund is a major asset.

6. Consider Financial Advice

For tailored strategies, a Qualified Financial Adviser (QFA) can help you align your savings and investments with personal goals, including structured plans for pension fund development.

Conclusion

The S&P 500’s history is a story of resilience and growth.

While no one can predict short-term market moves, history shows that patience and a disciplined approach to savings, investments, and pension fund building are often rewarded.

Today’s environment presents challenges, but also opportunities for informed investors to build wealth sustainably.

What is the S&P 500 and why is it important?

The S&P 500 is a stock market index that tracks the performance of 500 of the largest publicly traded companies in the U.S.

It serves as a benchmark for the overall health of the stock market and a useful indicator of long-term investment trends.

Why should I invest in the S&P 500?

The S&P 500 has historically delivered strong long-term returns, averaging about 10% annually before inflation.

It includes diverse sectors and companies, making it a core element in many pension funds and long-term investment strategies.

It is reccomended to seek financial advice before making investments.

How can I invest in the S&P 500 from Ireland?

Irish investors can access the S&P 500 through Exchange-Traded Funds (ETFs), pension funds (like PRSAs or personal pensions), and investment products offered by life assurance companies.

Always seek advice from a Qualified Financial Adviser (QFA) to ensure suitability.

What does ‘time in the market, not timing the market’ mean?

It refers to the idea that consistently staying invested in the market over time is usually more effective than trying to predict short-term market highs and lows.

Long-term investing tends to smooth out volatility and yield better returns.

How does this relate to pension planning?

Investing in assets like the S&P 500 through a pension fund allows you to benefit from compound growth and tax advantages.

Over time, this can significantly enhance your retirement income.

Should I be concerned about market volatility right now?

Short-term market volatility is normal. The key is to have a diversified portfolio and a clear financial plan that includes long-term goals, such as building pension funds and accumulating savings for future needs.

How can I protect my savings and investments in volatile markets?

- Diversify across asset classes and regions.

- Rebalance your portfolio regularly.

- Maximise tax-efficient pension contributions.

- Review your financial plan with a QFA annually.

Is now a good time to start investing or contributing to my pension?

Yes. The best time to invest or contribute to your pension was yesterday; the second-best time is today.

Even during market downturns, regular contributions help average out your investment cost over time (a strategy known as euro cost averaging).

Can I use this strategy for my children’s education savings too?

Absolutely. Long-term investment principles apply equally to education savings, especially if the time horizon is 5 years or more.

Consider tax-efficient structures and low-cost investment options.

Where can I get personalised advice?

- Warning: Past performance is not a reliable guide to future performance.

- Warning: This product may be affected by changes in currency exchange rates.

- Warning: The value of your investment may go down as well as up.

- Warning: If you invest in this product you may lose some or all of the money you invest.