1. Know Your numbers

Financial Analysis- Track your spending for 3 weeks.

- Don’t change anything.

- Be honest about every cent.

2. Keep A

Spending

Diary

- Do you have triggers – lunches, clothes, video games, drinks?

- Do you spend more or less on some things than you thought?

- How many Direct Debits and Subscriptions do you have?

- Use apps like fudget or just a spread sheet or a notebook.

- Use online banking to look at the previous months. Make sure you account for all purchases.

3. Colour Code budget

- Not all spending is equal. Here’s how to use Financial Planning to split your spending into three groups:

ORANGE

- Fixed

- Regular

- Non-Negotiable

- Rent

- Mortgage

- Debts

- Loans

Yellow

- Less Fixed

- Regular

- Needs planning to change

- Utilities

- Phones

- Subscriptions

- Contracts

Green

- Flexible

- Frequent / Regular

- Needs little effort to change

- Groceries

- Recreation

- Grooming & Clothes

4. Income & Expenditure

Fiach & Angela: Case Study- Fiach & Angela, 26, have a combined income of €4,500 per month.

- Their rent is €1,550 per month.

- They have a car loan of €300 per month.

- They spend €100 per month on their phones.

- Their utilities, like broadband & electricity, cost €300 per month.

- They have a life insurance policy that costs €51 per month.

- Their groceries cost roughly €700 per month.

- They spend roughly €712 on clothes, recreation, etc.

- Between public transport & taxis, they spend €100 per month.

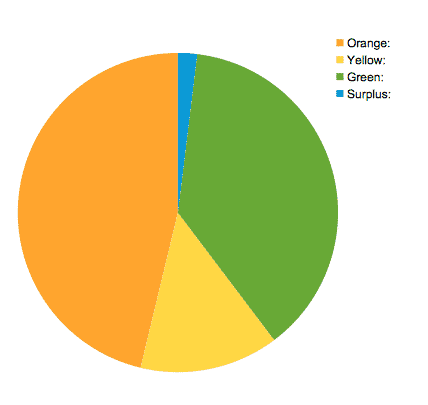

- 46.3% on Orange, fixed expenditure;

- 14% on Yellow, monthly expenditure;

- 37.8% on Green, flexible expenditure;

- 1.9% is left as the Surplus.

5. Switching & Saving

Act Daily, So You Can Plan YearlyLook at your Spending Diary:

- How many Direct Debits do you have, and what do they do?

- Check your contracts and subscriptions. Do you need them all?

- Mark when the contract is up in your calendar

- Compare providers for the best deal

- Change when your contract is up

- Check how long until your contract runs out

- Check the cancellation fee

- If the fee costs less than your bill until the end of your contract, can you afford to cancel now, rather than later?

6. Spread Big Yearly Payments

Example: Car Costs

Caoimhe runs a car she owns outright, so she doesn’t have to worry about a loan each month. Unfortunately, between August & September, Caoimhe receives bills for:| Motor Tax: | €390 |

| Car Insurance: | €1,500 |

| NCT: | €55 |

| Servicing & Repair: | €800 |

| Total: | €2,778 |

- She can start saving now for her car costs

- Saving €232 p/m for a year will cover all her costs, based on last year.

- If €232 is too much, €150 p/m is more affordable for Caoimhe.

- This will cover her tax & insurance.

- If Caoimhe can pay her tax & insurance in one payment, she can avoid paying interest on monthly payments

- This interest can be as high as 20%, so Caoimhe could be saving €378 per year.

7. Setting Your Targets

Achieving Your Goals:

- Don’t just tell yourself to spend less.

- Decide to save this amount, by doing that: If you bought a pack of crisps each day at lunch, for .85¢, 5 days a week, you could save €204 per year by cutting it out.

- Set yourself Short-Term, Middle-Term & Long-Term goals.

- Short-Term goals can be as simple as cutting out a bad habit, and saving that money.

- Middle-Term goals can be switching your contracts for a better deal.

- Your Long-Term goals can be anything from a savings goal, clearing your debt, or building the deposit on your home.

- Short and Middle-Term goals are the small steps that will help you get there.

8. More Ideas

Let’s get started!Challenge Yourself:

- Look at your bank statements from this month last year. Can you spend less, and beat that month?

- Try a day per week where you spend nothing.

- The week after a bank holiday is the perfect time to try meal planning. Your weekend is longer, and your week is shorter.

- Like car costs, plan some spending yearly & keep a separate account for this fund.

- Give yourself a fixed amount each year to spend on clothes or grooming. Do you have options to repair, rather than replace?

- Planning ahead can allow you to purchase better quality replacements, which will last longer.