Some holders of Whole of Life insurance in Ireland are receiving very worrying letters, informing them that their policies have been reviewed, and their premiums increased.

In some cases, a monthly Whole-of-Life premium increase can be 680% more than the original payment. We’re going to discuss why this is happening, and what to do about the unit-linked whole-of-life policy.

What is a Whole of Life Insurance Policy?

It’s a unit-linked whole-of-life insurance policy that insures you for your whole life, or as long as you keep paying premiums. The cost of these whole-of-life assurance policies in Ireland is higher than with term life policies, where you are only covered for a defined period of time.

HOW MUCH DOES LIFE INSURANCE COST IN IRELAND?

It depends how much you’d like to insure yourself for, and on the type of policy you’d like.

What’s the difference?

There are two basic types: Reviewable Whole-of-Life, and Guaranteed Whole-of-LifeGUARANTEED WHOLE-OF-LIFE INSURANCE IN IRELAND

A Guaranteed Whole-of-Life policy charges a fixed premium for a fixed amount of cover, payable for life. From the cost of a claim to the admin & running costs and the Government levy, these life insurance costs are all included in your monthly reviewable premium.

REVIEWABLE WHOLE-OF-LIFE INSURANCE IN IRELAND

A Reviewable Premium Whole-of-Life policy charges a regular premium for a certain level of coverage. The policy does not guarantee to provide coverage throughout life. The premium and cover are subject to regular reviews.

These policies are also known as Unit-Linked whole of life policy policies. A unit-linked whole-of-life policy is a policy whose encashment value is linked to the value of units in a company’s unit fund. This is an investment fund operated by the life company.

If the value of the fund doesn’t grow to pay for the cover, the premium will be reviewed, and increased.

Okay, I’ll take the one that doesn’t increase in price. Obviously.

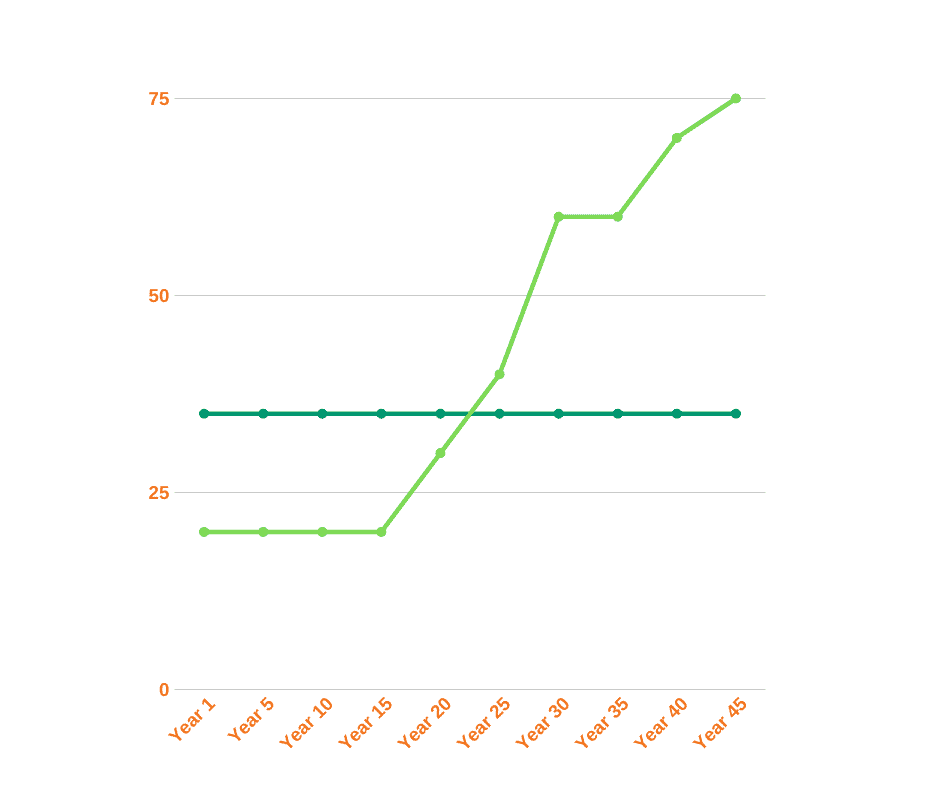

Very wise. Unfortunately, Reviewable Premium Whole-of-Life policies can often start cheaper. And stay cheaper for a long time, and then, once you hit 60, the premiums are reviewed every year. The Whole of Life premium increase can be hundreds of per cent more than the original payment. This is what it can look like:

The initial premium quoted for a Guaranteed Whole-of-Life policy is high, compared to a Reviewable premium policy.

However, as the policy continues, the reviews may increase the Reviewable premiums sharply.

This can be a particular problem if the insurer covers the cost of a policy that isn’t performing and neglects to perform the first few reviews.

When the reviews are finally issued, the premium can increase drastically.

So what happens if your whole-of-life premium assurance increases?

You have three choices:

- If you can’t pay the new premium, your insurer may agree to give you the cover of a very small amount for your original premium.

- Or, you can choose to encash this policy – but, if your premiums have increased drastically, the fund may not have much to encash.

- You can choose to get a new policy somewhere else.

But I’ve had this policy since the ‘80s or ‘90s! A new policy now will be too expensive!

Not necessarily. Reviewable Whole-of-Life assurances were very common in the ‘80s, even for things like Mortgage Protection. A lot of people who originally purchased these policies in their 20s & 30s are getting their first reviews now, in their 60s, and it can come as quite a shock.

Slightly Shocking Example!

In a recent case resolved by the Financial Ombudsman, a policy-holder who had a Reviewable Whole-of-Life policy was paying €192 per month. However, following their review, their new premium was quoted as €1,500 per month!

This policyholder was 53 when they received this premium hike. Sadly, they could not find another cover, due to ill health, etc. This is why they had to complain to the Financial Ombudsman.

So what could you do if you received a premium review of this size?

The good news is, many new life policies are simpler products, with simpler underwriting.

The couple above had:

€408,488 cover on the First Life, with Accelerated Serious Illness Cover

€204,731 cover on the Second Life, with Accelerated Serious Illness Cover

For €192.44 p/m

Guaranteed Whole-of-Life insurance policies in Ireland don’t offer Serious Illness Cover, and now policies will offer Dual Life payouts (on both deaths)

For just Life Cover, at the above amounts, I could quote €900 p/m on a Dual Life basis, which is cheaper than their reviewed premium.

But let’s look at the situation again:

Many of these policies were sold to be used as a form of Mortgage Protection, etc. We now have much simpler products to protect mortgage loans.

The shape of your life may have changed since you originally took out your unit-linked whole-of-life policy too. If your family have all grown up, you have lower expenses and have built a pension fund, you may need a lower amount of whole of life assurances.

HOW CAN A BROKER HELP?

Let’s say you’re both 55, have €150,000 remaining on your mortgage, and your family is almost grown. You’re used to paying €192 per month. What can your broker find for you?

You can get quotes for €150,000 Mortgage Protection, for 10 years, on a dual life basis, for €49 p/m.

With one of our insurers, you can also get dual life protection for 25 years, for €150,000 each, with an added benefit of €25,000 paid on death after the 25-year term is up, for €164 p/m.

Paying €164 p/m, for 25 years, will cost €49,200 in total.

You will still be guaranteed a payout of €50,000 minimum, or €300,000 total if you both died within the 25-year term.

IF YOUR WHOLE-OF-LIFE PREMIUM INCREASE HAS COME AS A SHOCK, YOU MAY HAVE MORE OPTIONS THAN YOU THINK.

If you’re worried, talk to us today. We specialise in finding out answers to your queries about whole of life insurance in Ireland and giving personalised advice. Call us on 01 853 2727, or contact us.

How we can help you

Our Recent Blog Posts

Manage Your Pension

Other Financial Services

Subscribe to our newsletter for regular information and ideas