Blogs

Inheritance Tax Ireland | How To Avoid Legally

by Debbie Cheevers | Jun 9, 2025

This content has been updated to reflect changes in Budget 2025Are you looking for ways to avoid inheritance tax? Inheritance tax is something people forget about until it's too...

Are Pensioners Exempt From Property Tax in Ireland?

by Debbie Cheevers | Jun 23, 2025

The annual Property Tax in Ireland is called the Local Property Tax (LPT). Local Property Tax is charged on residential properties in Ireland. There are no specific local...

Capital Gains Tax Ireland 2025 – Rates, Reliefs, and How to Pay CGT

by Debbie Cheevers | Jun 18, 2025

If you're investing, selling property, or transferring assets, understanding Capital Gains Tax (CGT) in Ireland is crucial. As of 2025, capital gain tax in Ireland remains one of...

Best Savings Account Ireland 2025 – Where to Get the Highest Rates

by Debbie Cheevers | Jun 10, 2025

If you’re wondering about the best savings account in Ireland are you’re not alone. With interest rates are changing and more savings products available, choosing the right...

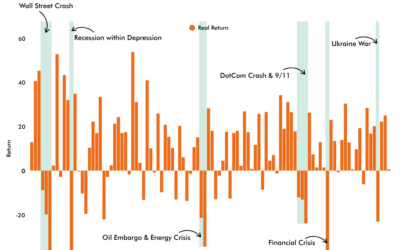

Investing Amid Volatility: A Long-Term Guide for Irish Investors

by Debbie Cheevers | May 28, 2025

In recent months in particular, financial markets have seen considerable volatility. Global economic uncertainty, interest rate adjustments, and geopolitical tensions have all...

Why Financial Advice Matters More Than Ever in 2025

by Debbie Cheevers | May 22, 2025

In today’s unpredictable economic climate, more Irish consumers are turning to Financial Brokers for expert guidance — and it’s paying off. The newly published Value of Advice...

What Are the Best Financial Tips for Your 20s?

by Debbie Cheevers | Apr 24, 2025

Your 20s are an exciting time filled with new experiences! But they’re also the perfect stage to set a solid financial foundation. Making smart financial choices early on can...

New Pension Rules 2025 for Company Directors

by Debbie Cheevers | Apr 17, 2025

The Irish government’s Finance Bill, published on 11 October 2024, introduces key updates to pension rules that are set to take effect in 2025. These changes impact Personal...

What’s the Difference Between Income Protection and Critical Illness Cover?

by Debbie Cheevers | Apr 10, 2025

Life can take unexpected turns, and when illness or injury comes, it’s essential to have the right financial protection in place. To help you prepare for these challenges, two...

How Much Does Executive Income Protection Cover in Ireland?

by Debbie Cheevers | Apr 3, 2025

Running a business comes with many challenges, and ensuring financial stability during unexpected times is essential. Executive income protection provides a reliable solution for...

How Much Does Partnership Protection Insurance Cost in Ireland?

by Debbie Cheevers | Mar 31, 2025

When it comes to running a business partnership, planning for the unexpected is crucial. If one partner were to pass away, financial challenges could quickly follow, impacting...

7 Tips for How You Could Grow Your Money in Your 30s and 40s

by Debbie Cheevers | Mar 27, 2025

Entering your 30s and 40s is an exciting time, often filled with career advancements, growing families, and new responsibilities. Meanwhile, it’s also the perfect moment to focus...

UK Pension Transfers to Ireland Using QROPS: A Comprehensive Guide

by Debbie Cheevers | Mar 18, 2025

For individuals moving from the UK to Ireland or planning retirement in Ireland, transferring a UK pension using a Qualifying Recognised Overseas Pension Scheme (QROPS) can be a...

Volatility A Feature of Investment Markets

by Debbie Cheevers | Mar 7, 2025

The past few months have been particularly turbulent for investors. Market volatility has surged, leading to sharp declines in stock prices and causing understandable anxiety...

Market Volatility & Managing Your Investments

by Debbie Cheevers | Feb 27, 2025

Market volatility is an inevitable part of investing, but that doesn’t make it any less stressful for clients. As financial advisors, it’s our role to provide perspective, keep...

February 2025: A Mixed Start to 2025

by Debbie Cheevers | Feb 26, 2025

As we step out of February 2025, navigating personal finances remains a key priority for individuals and families across Ireland. Ireland's economy has shown resilience amid...

January 2025: A Financially Impactful Start To The Year

by Debbie Cheevers | Jan 31, 2025

January 2025 has kicked off with major events, including the formation of a new government and Storm Éowyn, which caused significant disruptions. Additionally, there are several...

Best Ways to Reduce Income Tax in Ireland For Self Employed

by Ian Gallagher | Jan 22, 2025

Are you feeling stressed by the amount of income tax you pay each year and looking for effective ways to reduce it? Paying income tax is a necessity, but understanding how to...

The Ultimate Guide to Auto Enrolment for Pensions

by Debbie Cheevers | Jan 21, 2025

Welcome to The Ultimate Guide to Auto Enrolment for Pensions: Everything You Need to Know. Are you unsure about the complexities of pension schemes and how auto enrolment works?...

APRC VS Interest Rate: What’s the Difference?

by Debbie Cheevers | Jan 10, 2025

APRC & Interest Rates On Mortgages Understanding APRC vs Interest rate is essential for knowing what you are being charged on your mortgage. Your mortgage is likely the most...

Pensions in Ireland: Why They’re a Smart Choice

by Debbie Cheevers | Jan 9, 2025

Pensions in Ireland are one of the most effective ways to secure your financial future. A pension isn’t just about planning for the future—it’s also about making smart financial...

Self-employed pensions

by Debbie Cheevers | Jan 9, 2025

Self-employed pensions are designed for individuals who work for themselves. As a self-employed individual, it is essential for you to think about retirement and plan for the...

What Taxes Do You Pay On Investments

by Ian Gallagher | Jan 6, 2025

Are you confused about the taxes you pay on investments? What taxes do you pay on investments. Many investors find it challenging to understand the complexities of investment...

How Does Income Protection Work In Ireland?

by Ian Gallagher | Jan 2, 2025

Looking for proper guidelines related to income protection in Ireland? Income protection insurance is a financial safety net designed to replace a portion of your income if you...

What Happens to Your Pension When You Die?

by Ian Gallagher | Jan 2, 2025

Are you thinking about what will happen to your pension when you pass away? Pensions are an important part of your financial planning, giving you an income for your retirement....

What Is the Tax Relief on Pension Contributions in Ireland?

by Ian Gallagher | Dec 6, 2024

Are you planning for your retirement and looking for ways to save money while reducing your tax bill? Understanding the tax relief available on pension contributions in Ireland...

How Much Does Life Insurance Cost In Ireland?

by Ian Gallagher | Dec 5, 2024

Understanding how much life insurance costs in Ireland can help you make informed decisions for your financial future. Life insurance is an essential safety net, providing peace...

How Much Do I Need to Retire in Ireland? Complete Guide

by Debbie Cheevers | Nov 11, 2024

Discover how much you need to retire comfortably in Ireland. Learn about retirement costs, state pension, personal savings, and more. Start planning today!

How Does Inheritance & Gift Tax Work in Ireland?

by Ian Gallagher | Oct 4, 2024

This content has been updated to reflect changes in Budget 2025In Ireland, gifting money to your loved ones is pretty easy, but it’s important to bear in mind that some gifts...

What Are The 3 Main Types Of Life Insurance?

by Debbie Cheevers | Jul 30, 2024

Life insurance serves as a crucial financial tool, providing peace of mind and financial security to individuals and families both. In Ireland, there are three primary types of...

Is Mortgage Protection Insurance Compulsory in Ireland?

by Debbie Cheevers | Jul 8, 2024

Mortgage protection insurance is a type of policy that pays off your home loan if you pass away before clearing the debt, ensuring that your family doesn't bear the burden of the...

Is Income Protection Taxable in Ireland?

by Debbie Cheevers | Jul 1, 2024

Income protection insurance is a crucial safety net for anyone who might lose their ability to earn due to illness or injury. This type of insurance provides you with a...

How To Calculate Tax On Pension Income?

by Debbie Cheevers | May 31, 2024

Planning for retirement involves more than just saving money; understanding how your pension income is taxed is essential for managing your finances effectively. Taxes on pension...

Are Pension Contributions Tax Deductible For Self Employed?

by Debbie Cheevers | May 27, 2024

Are you self-employed and wondering if you can reduce your taxes by contributing to a pension plan? As a self-employed individual, planning for your financial future is crucial,...

Does Income Protection Cover Redundancy?

by Debbie Cheevers | May 17, 2024

Income protection insurance is designed to help you financially if you're unable to work due to illness or injury, by providing a regular income. However, many people are unsure...

How Pensions Work for the Self-Employed?

by Debbie Cheevers | May 13, 2024

Are you self-employed and wondering how to secure your financial future? Thinking about retirement can feel overwhelming, especially when you're managing your own business....

Ways to Jump-Start Your Financial Future

by Debbie Cheevers | Oct 9, 2023

Your financial future isn't something that materialises out of the blue. It is a detailed, thought-out process that begins with steps taken today. A stable financial future is a...

What are Approved Retirement Funds (ARFs)

by Debbie Cheevers | Aug 17, 2023

If you're planning for retirement in Ireland, you may have heard of an approved retirement funds (ARF). But what exactly is an ARF, and how does it work? This guide will provide...

How much do I need for my pension?

by Debbie Cheevers | Aug 11, 2023

How much should I save for my pension? It’s a question we are often asked as financial advisors. When you’re starting a pension, the first thing you calculate is how much money...

How Do You Scale Up a Business? Key Strategies and Tips

by Adrian Gallagher | Jun 20, 2023

Looking to grow your business but not sure how? Scaling up is a common ambition for entrepreneurs wanting to increase revenue, customer reach, and impact. The process is...

What is SWOT Analysis in Business?

by Adrian Gallagher | Jun 17, 2023

Does your business struggle to identify its strengths and weaknesses or understand the opportunities and threats in your market? Feel like you're operating in the dark? Greenway...

Do I Need to Register If I Have an Online Business?

by Adrian Gallagher | Jun 17, 2023

Today, running an online business has become an attractive opportunity for many individuals. It's a platform that offers freedom, flexibility, and the potential for financial...

Digital Marketing Strategies For Small Businesses

by Adrian Gallagher | Jun 17, 2023

Digital marketing is no longer an option—it's a necessity. An effective digital marketing strategy can make or break your business in a rapidly evolving digital era. This...

How to Start a Business in Dublin: A Comprehensive Guide

by Adrian Gallagher | Jun 17, 2023

Whether you're an aspiring entrepreneur with a great idea or a seasoned professional looking to expand your ventures, starting a business in Ireland's capital city can be a...

How to Plan Your Pension: A Comprehensive Guide by Greenway Advisors

by Debbie Cheevers | Jun 1, 2023

Planning your pension is crucial to ensuring financial stability in your later years, and this applies everywhere, including in Ireland. As life expectancy continues to increase...

Auto Enrolment Pensions For Employers

by Debbie Cheevers | Apr 25, 2023

Updated with new auto enrolment information Janurary 2025If you're an employer in Ireland, from 2025 you will have a legal obligation to automatically enrol eligible employees...

5 Tips You Need to Ask About Money

by Debbie Cheevers | Feb 17, 2023

Do you feel like you have no control over your money? Knowing the right questions to ask about money is the key to taking control of your finances. From budgeting to saving for...

What is business management?

by Adrian Gallagher | Feb 14, 2023

Business management is a term lots of people search for. But what are they really looking for? Business management is the practice of leading a team or organisation to achieve...

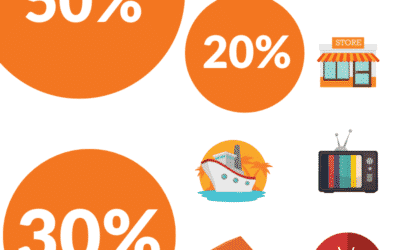

Achieve Financial Freedom Using The 50/30/20 Money Management Method

by Ian Gallagher | Dec 22, 2022

If you’re looking for a simple and easy way to budget your money, the 50/30/20 money management method may be perfect for you. This technique prioritizes needs over wants and...

How Much is The State Pension in Ireland?

by Debbie Cheevers | Sep 27, 2022

As retirement approaches, one of the most pressing concerns is income. In Ireland, the state pension provides a regular source of income in later life. Understanding how much to...

Business advice for construction: Electrician | How our advice helps

by Ian Gallagher | Jun 22, 2022

Our business advice service offers business owners a long-term supportive environment to develop their business. Greenway works with the business owner to build structures and...

MAXIMISE YOUR PENSION CONTRIBUTIONS IN IRELAND

by Debbie Cheevers | Oct 12, 2021

Maximising your pension contributions in Ireland is a great way to provide you with an appropriate income for your retirement while reducing your tax bills. Indeed, it helps you...

How to budget your money?

by Debbie Cheevers | Sep 20, 2021

No matter what your financial situation is, knowing where your money is going each month is essential. Having a budget helps you be more in control of your finances and let you...

Best Ways to Reduce Income Tax In Ireland

by Debbie Cheevers | Sep 15, 2021

Are you self-employed in Ireland? And, filing your income tax return every year? And want to know how to pay less tax as a self-employed person? This article is for you. If you...

Early Retirement in Ireland – Achieve Financial Freedom

by Debbie Cheevers | Sep 1, 2021

In Ireland, people generally retire at 66 because it’s the current age at which they qualify for the state pension. However, in the coming years, the retirement age is most...

What Happens to Your Pension When I Die?

by Debbie Cheevers | Aug 18, 2021

What happens to your pension when you die? Who gets your pension if you die? These are questions that many people in Ireland are asking these days. It actually depends on two...

HOW TO PICK A PENSION FUND IN IRELAND?

by Debbie Cheevers | Jul 9, 2021

With so many options out there, it can be overwhelming to choose a pension fund in Ireland. Before making your decision, a couple of elements need to be taken into account. If...

Employer Pension Contributions in Ireland

by Debbie Cheevers | Jul 8, 2021

In Ireland, Employer Pension Contributions are payments made into an employee’s pension scheme by their employer. As an employee, it is important to know what exactly these...

What is a pension plan?

by Debbie Cheevers | Jun 25, 2021

You probably already know about pensions. But do you know the real meaning of a pension? A pension is the money you live on once you retire, you will use to live on when you...

PENSIONS & ENHANCED TRANSFER VALUES IN IRELAND

by Debbie Cheevers | Jun 21, 2021

Enhanced Transfer Values in Ireland are offered to former employees as a one-off opportunity for their pension transfer values. The value of this transfer is often high. It is...

What are avcs pensions?

by Debbie Cheevers | Jun 16, 2021

Do you find yourself with extra money at the end of the month? If you are a pension scheme member, you can invest more money into your current pension. Indeed, you can achieve...

Employee pension scheme vs. Private scheme

by Debbie Cheevers | Jun 8, 2021

Choosing the type of pension you want can be a challenge. With the huge number of options available to you, it's important to know what's best for you. Sometimes our employer...

7 good reasons to start a pension

by Debbie Cheevers | May 28, 2021

Today, we are talking about reasons why you should start a pension. Have you ever thought about what your life will be like once you retire? The best way to secure your future is...

Pensions and divorce in Ireland

by Debbie Cheevers | May 21, 2021

After the family home, the divorce pension is often the most valuable asset a divorcing couple can have. Therefore, you need to know what happens to it in the event of separation...

Pension term insurance

by Debbie Cheevers | May 14, 2021

What is Pension Term Insurance? Pension Term Insurance is a life insurance policy that covers you up until retirement. If you were to die before you reached retirement your...

How to save money in 2021

by Debbie Cheevers | Apr 9, 2021

Today, more than ever, it is important to have some money aside. Whether it's for buying a home, getting out of debt, or achieving financial freedom, saving money is crucial....

Tax Relief On Pension Contributions In Ireland

by Debbie Cheevers | Jan 4, 2021

You may already know, that investing in a pension has many advantages. It allows you to save properly, can protect your funds from inflation, and possibly increase your wealth...

Rotary Club of Dublin Fingal Annual Christmas Appeal

by Ian Gallagher | Dec 15, 2020

Adrian Gallagher is a member of the Rotary Club of Dublin Fingal. Generally at this time of year, Rotary would do charity bucket collections at supermarkets. The money...

Should I Invest Now?

by Debbie Cheevers | Nov 11, 2020

top 5 tips for Beginner investors Find out what options you have for your savings and unexpected lump sums. Interest rates are low at the moment, but take some time to research,...

Your Credit Rating and COVID

by Debbie Cheevers | Aug 12, 2020

credit rating - What is it? Your credit rating is held with the Irish Credit Bureau. It is where all your financial payment history is stored. It shows your payment and loan...

7 tips to start a business

by Adrian Gallagher | May 20, 2020

7 tips to start a business in Ireland today. We’ve outlined 7 tips for when you're starting your business in Ireland. We have over 40 years of experience running all types of...

GDPR And Working From Home

by Debbie Cheevers | May 19, 2020

Greenway's Top 7 Gdpr tips GDPR caused a big panic in 2018 when the legislation came into force, and most of us made our workplaces GDPR-compliant. But what happens when the...

How to grow sales in ireland

by Debbie Cheevers | May 6, 2020

Tips to Grow Sales in Ireland Whether you sell products or services, you want to grow sales. We’re going to look at developing sales with business clients & private clients,...

Website Design – What You Need To Know

by Debbie Cheevers | Apr 20, 2020

Website Design - Our Top 5 Tips to Get The Best Site You Can Now more than ever, people want to get their businesses online. Get the best out of your Website Design through...

Business Success During & After Coronavirus

by Adrian Gallagher | Apr 9, 2020

BUSINESS SUCCESS DURING & AFTER CORONAVIRUS How will you have business success during & after coronavirus? Check our top tips and ideas below. We have over 40 years of...

Life Insurance and Coronavirus

by Debbie Cheevers | Apr 8, 2020

How will the current Coronavirus & COVID-19 Pandemic affect your Life Insurance? There have been several news stories about insurance companies refusing to cover claims...

Working from home in Ireland

by Debbie Cheevers | Apr 1, 2020

Working from home in Ireland Find out about working from home in Ireland, and what makes a good remote worker? Many people are trying to remote work for the first time. We’ve...

Payroll and COVID-19 Pandemic Payment

by Debbie Cheevers | Mar 24, 2020

Did you have to let your staff go temporarily? As it gets near to your end of month payroll date, here’s how to use the COVID-19 Refund Scheme.We'll Answer Your Questions!What is...

Welfare in Ireland and Coronavirus

by Debbie Cheevers | Mar 18, 2020

What are your Welfare options right now? - March 2020 If you’ve recently lost your job, or are now working on reduced hours, you need to know what welfare you’re entitled to, and...

Free Coronavirus Business Advice

by Adrian Gallagher | Mar 18, 2020

Coronavirus Business Advice To help businesses during the coronavirus economic shock, we are making 5 FREE Coronavirus business advice consultations available. Just answer the...

Coronavirus Business Survival Plan

by Adrian Gallagher | Mar 17, 2020

Coronavirus business survival plan Coronavirus is having a severe and traumatic impact on our economy. Our six-point plan to fight the COVID-19 economic shock will help you...

Coronavirus mortgage repayment

by Debbie Cheevers | Mar 11, 2020

Coronavirus & mortgage repayments. Coronavirus mortgage repayment, If you’re reading worrying stories about quarantines, and coronavirus, it’s important to know how this...

Parental Leave for Employees

by Debbie Cheevers | Feb 27, 2020

What is Parental Leave in Ireland? How to take the right leave, at the right time – Greenway Financial Advisors answers your questions

4 ways to save more money in 2020

by Debbie Cheevers | Feb 7, 2020

4 ways to save money in 2020 Trying to save money is often challenging, especially when you think that there is nothing left to cut. Since the January blues are now over, take...

WHAT IS P60 IN IRELAND?

by Debbie Cheevers | Jan 28, 2020

If you’re currently working, you might be wondering where your P60 revenue is right now. Especially if you’re planning on applying for a mortgage this year. (Many lenders require...

What is Critical Illness Cover?

by Debbie Cheevers | Jan 22, 2020

What is critical illness cover? Critical illness cover is a type of insurance designed to provide financial protection in the event that you're diagnosed with a severe illness....

5 Easy Steps to choose a financial advisor

by Debbie Cheevers | Jan 17, 2020

5 easy steps to choose a financial advisor Whatever your income, everyone should get impartial & practical Financial Advice throughout their lives. Financial Advisors offer...

WILL MY WHOLE OF Life INSURANCE INCREASE IN IRELAND?

by Debbie Cheevers | Dec 23, 2019

Some holders of Whole of Life insurance in Ireland are receiving very worrying letters, informing them that their policies have been reviewed, and their premiums increased. In...

Budget Planning Tips & Ideas to make your life easier

by Ian Gallagher | Dec 4, 2019

Budget Planning Tips & Ideas to make your life easier We can help you solve your personal budget woes with our top 5 budget planning tips & Ideas. Planning your finances is...

What’s a PRSA Pension Explained

by Debbie Cheevers | Nov 18, 2019

PRSA or personal retirement savings account is a long-term personal pension plan that can let you save for retirement in a flexible way. Most people can get a PRSA pension in...

Simple guide to your pension options.

by Ian Gallagher | Nov 13, 2019

Pensions can be confusing and overwhelming at the best of times. At Greenway we focus on giving clear information to explain what is happening with Pensions in Ireland in 2019....

Start Financial Planning Today!

by Debbie Cheevers | Oct 30, 2019

Why Financially Plan? Tracking your income & expenditure gives you a road map to follow. Financial Planning allows you to plan for the future. Knowing where your money goes...

The Self-Employed Guide to Mortgage Applications

by Debbie Cheevers | Oct 11, 2019

SELF-EMPLOYED? HERE’S WHAT TO WATCH OUT FOR WITH YOUR MORTGAGE APPLICATION Whether you’re a First Time Buyer self-employed, you’re trading up, or switching mortgages, there are a...

What Is A Greenway Financial Review?

by Ian Gallagher | Sep 30, 2019

Getting a financial review is a great way of creating a roadmap or plan for where you want your personal finances to end up.

Mortgage Application Guide For First Time Buyers

by Ian Gallagher | Aug 27, 2019

Follow our simple mortgage application guide for first time buyers. If you're making your mortgage application soon, or you're still on the path to saving your house deposit,...

Managing Your Money

by Debbie Cheevers | Jun 17, 2019

Managing your money is crucial for your success at saving, but what does it mean? Do a search for ‘spending diary’, or ‘what I spent this week’. I would argue that out of the...

The Best Mortgage Protection Policy 2019

by Ian Gallagher | Jun 1, 2019

Which is the best policy? There's no simple answer to the question, but here's how the policies we offer compare. You'll find the best choice for you. Greenway Financial Advisors...

How Tax Reliefs Can Help You Save

by Debbie Cheevers | May 17, 2019

Savings can take a while. Don't become disheartened, tax reliefs could be a way to increase your savings quicker. If your savings are building slowly, don't be tempted to spend...

Financial Planning for Millennials

by Debbie Cheevers | May 14, 2019

How Financial Planning can help cash-strapped Millennials: There are plenty of times when we wonder if we'll ever feel like adults. Financial Planning is a thing that makes us...

Is Online Life Insurance Safe?

by Debbie Cheevers | May 7, 2019

There have been some discussions in the news recently. Is your online life insurance safe? The Financial Services and Pensions Ombudsman released their Overview of Complaints and...

Explaining Income Protection And Long-Term Renting

by Debbie Cheevers | Apr 30, 2019

Whether you think rent is dead money, or a mortgage is lodestone around your neck, the chances are you'll spend a long time renting. A...

Changing Your Mortgage Protection – Is It Worth It?

by Debbie Cheevers | Apr 25, 2019

Can changing my Mortgage Protection really make a saving? It can. When the newspapers advise you to make a switch, they mention savings of €2,000 to €7,000 over the life of the...

Co-Habitation and Mortgage Protection

by Debbie Cheevers | Apr 24, 2019

it's fine to not get hitched... Weddings are extremely expensive. You and your partner made the right choice not to do it. You're building a life that isn't just about one day,...

Online Brokers and Mortgage Protection Savings

by Debbie Cheevers | Apr 16, 2019

IS MORTGAGE PROTECTION WITH A BROKER DIFFERENT TO MORTGAGE PROTECTION FROM THE BANK? Online brokers can help make you some significant money and time savings on your mortgage...

FUNERAL INSURANCE PLANS

by Debbie Cheevers | Apr 16, 2019

What is a Funeral Insurance Plan? Funeral Insurance can be a number of things. It’s essentially a life insurance policy that pays out on death, with the sum being used to cover...

New Mortgage Protection In Your 50s

by Debbie Cheevers | Apr 15, 2019

What do Generation X and Baby Boomers have in common? You probably got Mortgage Protection before it was cool, like a lot of other things....

Switch Your Mortgage Protection Policy

by Debbie Cheevers | Mar 28, 2019

That's a brilliant quote! So much cheaper than what you're paying. You should definitely change your policy, shouldn't you? Take a deep breath, and check a few things first: How...

Know Your Life Insurance Options: A Glossary

by Debbie Cheevers | Dec 11, 2018

GLOSSARY OF COMMON TERMS “CONVERSION” This option allows a policy to be changed to a different policy, at the end of the policy term. This can be done without new evidence of...

Fill Out Your Life Insurance or Mortgage Protection Forms

by Ian Gallagher | Apr 16, 2018

It’s tempting to try to fill out your life insurance or mortgage protection forms as fast as possible. It’s easy isn’t it? Like an exam on yourself, so how could you get it...

Update Your Life Insurance Policy

by Ian Gallagher | Dec 7, 2017

Congratulations! That’s brilliant! You got married, had a baby, stopped smoking - there are so many ways that life can change. Do you know that this can affect your life...

GROUP VS INDIVIDUAL MORTGAGE PROTECTION INSURANCE IN IRELAND

by Ian Gallagher | Nov 9, 2017

What is mortgage protection? Mortgage protection insurance policies break into two groups. Group policies and Individual policies. There are some serious differences between the...

Mortgage Protection & Taking Your Time: Don’t Let Them Rush You.

by Ian Gallagher | Jul 24, 2017

When you're buying a home, it can feel like the process will never end. Saving, viewings, mortgage applications, and an avalanche of paperwork. Important decisions can be rushed...